- Key features of PNB RuPay Select Patanjali Credit Card:

- Benefits of PNB RuPay Select Patanjali Credit Card:

- Fee’s and Charges of PNB RuPay Select Patanjali Credit Card:

- PNB RuPay Select Patanjali Credit Card Reward Redemption

- Eligibility to Apply for PNB RuPay Select Patanjali Credit Card:

- Required Documents for PNB RuPay Select Patanjali Credit Card:

- Comparison:

- Apply for PNB RuPay Select Patanjali Credit Card:

- Contact PNB RuPay Select Patanjali Credit Card:

- Conclusion:

- F.A.Q’s:

- Read More

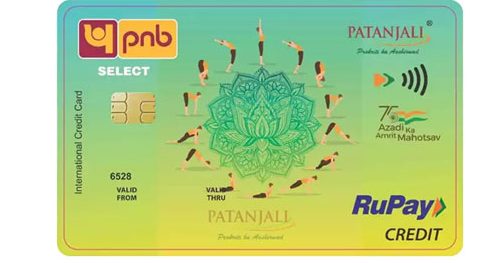

The PNB RuPay Select Patanjali Credit Card embodies riches, health, and happiness.Credit cards have developed beyond their original function as a means of payment in a time when financial transactions are ingrained into every aspect of our everyday lives. They now provide access to a world of privileged benefits that are suited to different lifestyles. In an innovative partnership, Punjab National Bank (PNB) and RuPay have come out with a credit card that not only meets your financial needs but also adheres to the Patanjali-promoted holistic wellness philosophy. Welcome to the PNB world.

Key features of PNB RuPay Select Patanjali Credit Card:

| Particular | PNB Patanjali Rupay Select Credit Card |

| Card Type | Entry-level |

| Best Suited for | Loyal customers of Patanjali |

| Joining Fee | Rs. 500 |

| Welcome Benefits | 300+ reward points on the first usage |

| Best Feature | 2X rewards on retail purchases |

Benefits of PNB RuPay Select Patanjali Credit Card:

Movie & Dining:

Exclusive discounts and cashback deals at various eateries.

Rewards Rate:

Every Rs. 150 spent earns you two reward points and 2% cashback on Patanjali goods.

Travel:

Free access to airport lounges.

Insurance Benefits:

Get a 10 lakh rupee accidental death insurance policy.

Zero Liability Protection:

If the loss of the card is reported to the bank in a timely way, the cardholder will not be responsible for any fraudulent transactions made using the lost or stolen card.

Other Benefits:

- The annual price is Rs. 750, while the joining fee is Rs. 500.

Card management smartphone app PNB Genie.

If you use the credit card at least once per quarter, there is no annual charge.

From Rs. 50,000 to Rs. 10 lakh is the credit limit.

On retail purchases, you receive twice as many reward points. - Earn 300+ reward points for your initial use.

- Take advantage of domestic and international lounge programmes.

Take advantage of over 300 retailer offers. - Receive 2% cashback on purchases over Rs. 2,500, up to a maximum of Rs. 50 per transaction, at all Patanjali locations.

- Users of PNB Patanjali RuPay Select cards would receive an additional cashback of 5-7% when they recharge using their Patanjali Swadeshi Samridhi Cards.

- Purchase personal and accidental death insurance totaling Rs. 10 lakh.

Fee’s and Charges of PNB RuPay Select Patanjali Credit Card:

| Particular | Fee |

| Spend based Waiver | If the cardholder uses the card at least once every three months, the yearly charge for the following year is eliminated. |

| Rewards Redemption Fee | Nil |

| Foreign Currency Markup | 3.5% of all foreign exchange deals. |

| Interest Rates | 2.95% per month |

| Fuel Surcharge | Waiver of the 1% fuel surcharge is limited to Rs. 350 each billing cycle. |

| Cash Advance Charge | 2% of the amount removed, capped at a certain minimum. |

PNB RuPay Select Patanjali Credit Card Reward Redemption

- You can redeem the reward points you earn with this card for a variety of goods, hotel reservations, cinema tickets, DTH/mobile recharges, and many more categories.

- By login into your PNB Rewardz account, you can redeem your points.

- Re.0.5 = 1 Reward Point.

- A minimum of 500 Reward Points are required for redemption.

- Only three years from the date of accrual are the Reward Points you earn with this card still valid.

Eligibility to Apply for PNB RuPay Select Patanjali Credit Card:

To qualify for any credit card, applicants must meet certain eligibility requirements depending on their age, income, credit score, place of residence, and other variables. The following are the basic requirements that you must meet in order to be approved for the PNB RuPay Select Credit Card:

- The principal cardholder must be between the ages of 21 and 65.

- The supplemental cardholder must be between the ages of 18 and 65.

- The candidate ought to be supported financially.

Required Documents for PNB RuPay Select Patanjali Credit Card:

- Any legitimate government-issued identification or address document is acceptable.

- A PAN Card copy.

- A photo the size of a passport.

- Latest three months’ worth of pay stubs as evidence of income for salaried people.

- Latest ITR for independent contractors.

Comparison:

PNB RuPay Select Patanjali Credit Card v/s PNB RuPay Platinum Patanjali Credit Card:

| PNB RuPay Select Patanjali Credit Card | PNB RuPay Platinum Patanjali credit card | |

| Fee | Joining Fee Rs. 500 Renewal Fee Rs. 750 | Joining Fee Nil Renewal Fee Rs. 500 |

| Best Suited For | Shopping | Shopping |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | First transaction receives a 300 bonus Reward Points bonus and retail purchases made within the first 90 days earn twice as many Reward Points. | 300 bonus Reward Points |

PNB RuPay Select Patanjali Credit Card v/s PNB RuPay Millennial Credit Card:

| PNB RuPay Select Patanjali Credit Card | PNB RuPay Millennial credit card | |

| Fee | Joining Fee Rs. 500 Renewal Fee Rs. 750 | Joining Fee Rs. 399 Renewal Fee Rs. 999 |

| Best Suited For | Shopping | Shopping |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | First transaction receives a 300 bonus Reward Points bonus and retail purchases made within the first 90 days earn twice as many Reward Points. | For retail and online purchases, you can receive 300 additional reward points when using a card for the first time within 90 days of issuance. Within 90 days after acquiring the card, earn 2x reward points on retail purchases and online transactions (apart from cash withdrawals and petrol). |

PNb RuPay Select Patanjali Credit Card v/s PNB global Gold Credit Card:

| PNB RuPay Select Patanjali Credit Card | PNB global Gold credit card | |

| Fee | Joining Fee Rs. 500 Renewal Fee Rs. 750 | Joining Fee Nil Renewal Fee Rs. 300 |

| Best Suited For | Shopping | Shopping |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | First transaction receives a 300 bonus Reward Points bonus and retail purchases made within the first 90 days earn twice as many Reward Points. | NA |

Apply for PNB RuPay Select Patanjali Credit Card:

Via Offline:

Obtain a physical application form from bank staff members, fill it out, and submit it along with the necessary documentation when you visit the Punjab National Bank branch that is the closest to you.

Via Online:

You can also print off the form from the PNB Card’s official we https://pnbcard.in bsite, complete it with all the necessary information, and then take it to your nearby branch together with the necessary supporting documentation.

Contact PNB RuPay Select Patanjali Credit Card:

Via Phone:

1800 180 2222 & 1800 103 2222 (Toll Free).

Via E-Mail:

care@pnb.co.in

Conclusion:

The PNB RuPay Select Patanjali Credit Card represents the values of health, prosperity, and wellbeing and is more than just a financial tool. By selecting this card, you are beginning to live a life that is rooted in balance and vigour as well as managing your financial affairs. Why not promote wellbeing with each swipe?

F.A.Q’s:

What is the PNB RuPay Select Patanjali Credit Card’s initiation fee?

The joining cost for the PNB Patanjali RuPay Select card is Rs. 500.

What is the PNB RuPay Select Patanjali Credit card’s credit limit?

The credit limit on the PNB Patanjali RuPay Select card ranges from Rs. 50,000 to Rs. 10 lakh.

Offers insurance protection the PNB Patanjali RuPay Select card?

Yes. For accidental death and total disability, the PNB Patanjali RuPay Select card gives insurance coverage worth Rs. 10 lakh.Yes. For accidental death and total disability, the PNB Patanjali RuPay Select card gives insurance coverage worth Rs. 10 lakh.

What is the PNB Patanjali RuPay Select card’s yearly fee?

The PNB Patanjali RuPay Select card has a 750 rupee yearly charge. However, if you use your card at least once every three months, this cost is eliminated.

Do PNB Patanjali Credit Cards charge fees for cash advances?

A. Yes, using your credit card to withdraw money from the bank will result in a cash advance fee of 2% of the amount withdrawn or Rs. 100 (whichever is larger). Therefore, it is advised against making cash withdrawals with your credit card since doing so may lower your credit score.

Can I use my PNB Patanjali credit cards to receive 2% cashback on every purchase?

No, you are only eligible for 2% cashback on purchases over Rs 2,500. This only applies to your purchases at Patanjali retail locations. Additionally, you are only eligible for a maximum reward of Rs. 50 per transaction.

What is the PNB Patanjali Credit Cards’ maximum credit limit?

After carefully reviewing your application, the bank determines the credit limit. Your credit limit won’t be shown to you until the verification process has been successful. When determining your credit limit, the bank takes into account a number of variables, including your credit score, income, ability to repay, and more.

What is the required credit score for a PNB card?

It is recommended to have a credit score of 750 or higher to apply for a credit card. Income Stability: PNB will provide credit cards to clients who are in possession of a reliable source of income. Both paid and self-employed customers are acceptable.

What is the interest rate on this credit card?

The PNB RuPay Select Patanjali Card has a monthly interest rate of 2.95%.

What is the annual fee on this PNB RuPay Select Patanjali Credit Card?

The PNB RuPay Select Patanjali Credit Card has a membership cost of Rs. 500 and an annual charge of Rs. 750.

Read More

I am a engineering student studying at Nimra college of engineering and technology(NCET)