- Introduction:

- Fee & Charges Associated With The Vistara Signature Credit Card:

- Introducing the Axis Bank Vistara Signature Credit Card:

- Important Features And Benefits Of Axis Bank Vistara Signature Credit Card:

- Cashback Program:

- Redemption Of Points On The Vistara Signature Credit Card:

- Unlocking Travel Perks:

- Eligibility And Requirements Needed To Apply For The Axis Bank Vistara Signature Credit Card:

- Managing Your Axis Bank Vistara Signature Credit Card:

- Check Axis Bank Vistara Signature Credit Card:

- Comparison:

- Contact:

- Conclusion:

- FAQs:

- Read More:

Introduction:

In today’s fast-paced world, where travel has become an essential part of our lives, credit cards have evolved into more than just a means of payment. They have transformed into powerful tools that provide a host of benefits, including cashback rewards and exclusive perks. One such credit card that stands out from the crowd is the Axis Bank Vistara Signature Credit Card, offering an array of travel-related privileges and an impressive cashback program. In this blog post, we will delve into the details of this card and explore how you can make the most of its cashback rewards, enhancing your travel experiences.

Fee & Charges Associated With The Vistara Signature Credit Card:

| Type of Charge | Fee |

| Joining fee | Primary – Rs.3,000 Add-on – Nil |

| Annual fee (from 2nd of card membership) | Primary – Rs.3,000 Add-on – Nil |

| Charges on purchases | 2.95% per month |

| Cash withdrawal charges | 2.5% of the amount withdrawn |

| Fees on cash transaction | Rs.100 |

| Re-issuing or replacement of card | Nil |

| Penalty for late repayment | Nil for > Rs.100 Rs.100 for Rs.101-Rs.300 Rs.300 for Rs.301-Rs.1,000 Rs.500 for Rs.1,001-Rs.5,000 Rs.600 for Rs.5,001-Rs.20,000 Rs.700 for dues above Rs.20,001 |

| Payments is foreign currency | 3.50% of the transacted amount |

| Surcharge on railway tickets | Dictated by IRCTC |

| Surcharge on fuel-related payments | 1% of the paid amount |

| Dishonour fee or cheque bounce | Rs.300 |

| Alerts on registered mobile number or balance enquiry | Nil |

Introducing the Axis Bank Vistara Signature Credit Card:

A premium travel-focused credit card that meets the needs of frequent flyers is the Axis Bank Vistara Signature Credit Card. This card combines the best travel benefits and cashback earnings thanks to a partnership with Vistara Airlines, one of India’s top airlines.

Important Features And Benefits Of Axis Bank Vistara Signature Credit Card:

- A new cardholder will get a free Premium Economy airline ticket as part of the Welcome perks. Every time a card is renewed, an airline ticket is provided.

- With a Vistara Signature Credit Card, a cardholder can enjoy Silver Club Vistara membership privileges like specialised check-in and excess baggage allowances.

- Axis Bank Dining Delights-affiliated restaurants provide discounts of up to 15% to patrons.

- The cardholder can earn 4 CV Points for every credit card purchase over Rs. 200. These points can be used to buy a variety of goods and services that the bank has mentioned.

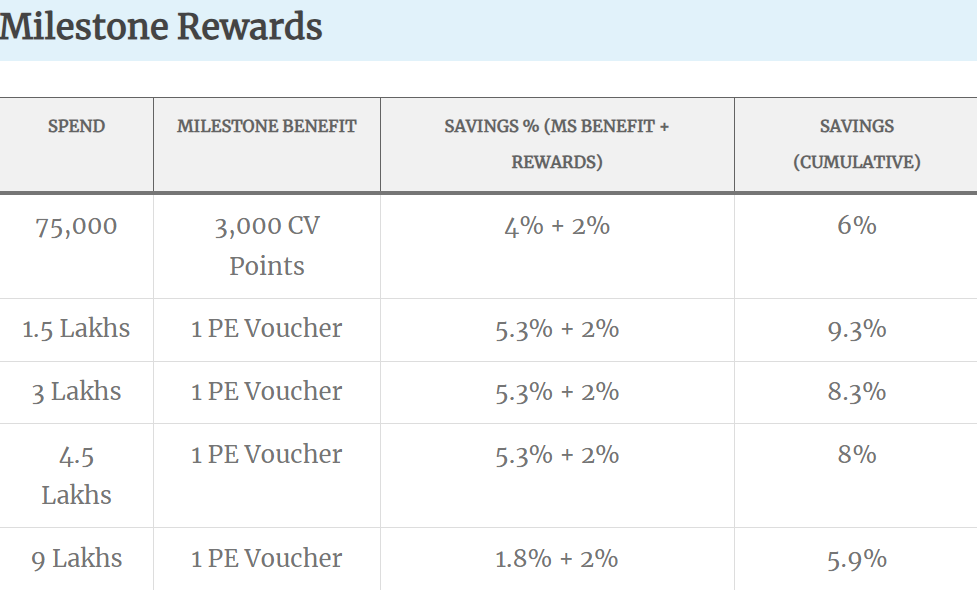

- Transactions totaling Rs. 75,000 within the first three months of card membership earn 3,000 CV points. For transactions over Rs. 1,50,000, Rs. 3,000, and Rs. 4,50,000, a free Premium Economy plane ticket is given.

- A cardholder may make insurance claims for up to Rs. 2,50,000 in air accident coverage and for lost cards up to 100% of the credit card amount.

- Equated Monthly Income (EMI) can be used as the repayment option for amounts over Rs. 2,500.

- Axis Bank provides Vistara Signature credit cardholders with unique lounge access at specific airports.

Cashback Program:

The Axis Bank Vistara Signature Credit Card’s comprehensive cashback programme is one of its notable features. Cardholders can receive cashback on a variety of purchases, including dining, buying online, and more. We will look over the cashback rates, spending requirements, and redemption choices for each of these categories in more depth.

Redemption Of Points On The Vistara Signature Credit Card:

- By accessing the Air Vistara website and providing the necessary information, one can determine their eligibility to redeem a “Award Flight.”

- After selecting the “Club Vistara” option, select the “Book a Flight” tab.

- Select “Redeem” and fill out the required information on the “Redeem Award Flight” page.

- Book the flight and speak with the customer service team for any additional guidance or questions.

Unlocking Travel Perks:

The Axis Bank Vistara Signature Credit Card offers a number of travel-related advantages in addition to cashback rewards that improve the overall travel experience. These include free entry to the lounge, quick earning of Vistara Club Vistara (CV) Points, free airline tickets, priority check-in, and many more. We will examine each of these benefits in depth, demonstrating how they improve your travel experience and increase the worth of your trips.

Eligibility And Requirements Needed To Apply For The Axis Bank Vistara Signature Credit Card:

- The cardholder must be an Indian citizen who is between the ages of 18 and 70.

- The total yearly income must be Rs. 6 lakh.

- The add-on cardholder must be older than 18 years old.

- During the application process, the applicant must provide their PAN or Form 60.

- Along with proof of address and income, the application for a Vistara Signature Credit Card must also contain a government-validated identity verification.

- Also required is a recent passport-size photo from the applicant.

Managing Your Axis Bank Vistara Signature Credit Card:

We will go over key management advice to make sure that using your Axis Bank Vistara Signature Credit Card goes well. This part will go through things like how to pay your bills, how to track your cashback benefits, how to keep an eye on your spending, and how to stay current with offers and promotions. You can get the most out of using your credit card by being proactive and well-organized.

Check Axis Bank Vistara Signature Credit Card:

Via Online:

There are two methods for checking the status of an Axis Bank credit card application online.

by means of the application ID (App ID)

with the help of a PAN card number and a mobile number

Via Application Id:

Step 1: Visit Axis Bank Credit Card in step one. Monitor the application page.

Step 2: Select the “App ID” link.

Step 3: Input the appropriate field’s “Application Reference Number”

Step 4: press “Submit”

Step 5: A screen will show the progress of your Axis Bank credit card application.

Via Phone number and PAN:

Step 1: Go to Axis Bank Credit Card – Track your application page at https://application.axisbank.co.in/cctracker/cctracker.aspx?cta=track-your-application-lic-cards-website (copy the link and paste it in the browser)

Step 2: Click on ‘PAN No / Mobile No’ alternative.

Step 3: Please input your PAN Number and mobile number in the corresponding fields, ensuring that the numbers match the ones provided in the application form.

Step 4: Click on ‘Submit’

Comparison:

Axis Bank Vitara Signature Credit Card v/s Axis Bank Vistara credit card

| Basis | Axis Bank Vistara Signature credit card | Axis Bank Vistara credit card |

| Fee | Joining Fee Rs 3,000 (plus applicable taxes) Renewal Fee Rs. 3,000 (plus GST) | Joining Fee Rs. 1,500 (plus applicable taxes) Renewal Fee Rs. 1,500 (plus applicable taxes) |

| Best Suited For | Travel | Travel |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | 1 complimentary Premium Economy Class air ticket and complimentary Club Vistara Silver Membership | 1 complimentary economy class ticket voucher |

Axis Bank Vitara Signature Credit Card v/s Axis Bank Vistara Infinite credit card

| Basis | Axis Bank Vistara Signature credit card | Axis Bank Vistara Infinite credit card |

| Fee | Joining Fee Rs 3,000 (plus applicable taxes) Renewal Fee Rs. 3,000 (plus GST) | Joining Fee Rs. 10,000 (plus applicable taxes) Renewal Fee Rs. 10,000 (plus applicable taxes) |

| Best Suited For | Travel | Travel |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | 1 complimentary Premium Economy Class air ticket and complimentary Club Vistara Silver Membership | 1 Complimentary Business Class ticket voucher |

Axis Bank Vitara Signature Credit Card v/s Axis Bank Signature credit card

| Basis | Axis Bank Vistara Signature credit card | Axis Bank Signature credit card |

| Fee | Joining Fee Rs 3,000 (plus applicable taxes) Renewal Fee Rs. 3,000 (plus GST) | Joining Fee Rs. 500 Renewal Fee Rs. 500 |

| Best Suited For | Travel | Shopping |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | 1 complimentary Premium Economy Class air ticket and complimentary Club Vistara Silver Membership | 2,500 bonus Edge Rewards on making at least 3 transactions within the first 30 days of card issuance. |

Contact:

Via E-mail:

customer.service@axisbank.com

Via Phone:

1860 419 5555

Conclusion:

The Axis Bank Vistara Signature Credit Card is an excellent choice for frequent travelers looking to enhance their journeys while earning cashback rewards. By taking advantage of its robust cashback program and travel perks, you can elevate your travel experiences to new heights. Whether you’re a seasoned traveler or an occasional adventurer, this credit card offers an array of benefits that cater to your needs. So, don’t miss out on the opportunity to unlock cashback rewards and make every journey truly rewarding with the Axis Bank Vistara Signature Credit Card.

FAQs:

Does the Axis Bank Vistara card grant access to lounges?

Free access to the lounge at a few Indian airports.Visit this page to see a list of the Vistara lounges that are participating. With Axis Bank EazyDiner, get 25% off up to Rs. 800 at our affiliated eateries all throughout the nation.

How many free rounds of golf are available to holders of a Vistara Signature credit card?

Club Vistara Silver Membership is free. 3 rounds of golf at some of the best golfing locations in India. Free access to domestic airport lounges at a limited number of airports around India (up to two each quarter).

Does Vistara offer complimentary meals?

All clients travelling in economy class on Vistara Airlines and paying economy flexi or standard rates will receive complimentary meals.

One CV point in Vistara is worth how much?

Earn three Club Vistara (CV) points for every Rs. 200 spent on all purchases. To purchase tickets on Vistara Airlines, use CV points (1 CV Point = Re.1)

What does the Vistara Signature Card’s aviation accident coverage entail?

A cardholder may make insurance claims for up to Rs. 2,50,000 in air accident coverage and for lost cards up to 100% of the credit card amount. Equated Monthly Income (EMI) can be used as the repayment option for amounts greater than Rs 2,500.

My Axis Bank Vistara Signature Credit Card is missing. What shall I do?

You must take the following actions if your Axis Bank Vistara Signature Credit Card is lost:

- Complaint to the bank.

- Immediately block the card.

Read More:

I am a engineering student studying at Nimra college of engineering and technology(NCET)