- Benefits And Features Of The Ace Credit Card

- No Limit On Cashback

- Access To Airport Lounges

- Waiver Of Fuel Surcharge

- Rules And Regulations

- Dining Treats

- Conversion To EMI

- Axis Bank Ace Credit Card’s Fees And Charges

- Criteria For Eligibility And Documents Needed For An Ace Credit Card

- Documents

- How To Apply Online For An Ace Credit Card From Axis Bank?

- Offline

- How To Contact Customer Service With Axis Ace Credit Card?

- Comparison: Axis Bank Ace Credit Card Vs. Flipkart Axis Bank Credit Card Vs. ICICI Amazon Pay Credit Card

- Axis Ace Credit Card Payment Options

- Axis Bank Ace Credit Card Limit

- Axis Bank Credit Card Balance Enquiry

- Conclusion

- FAQs

- Read More

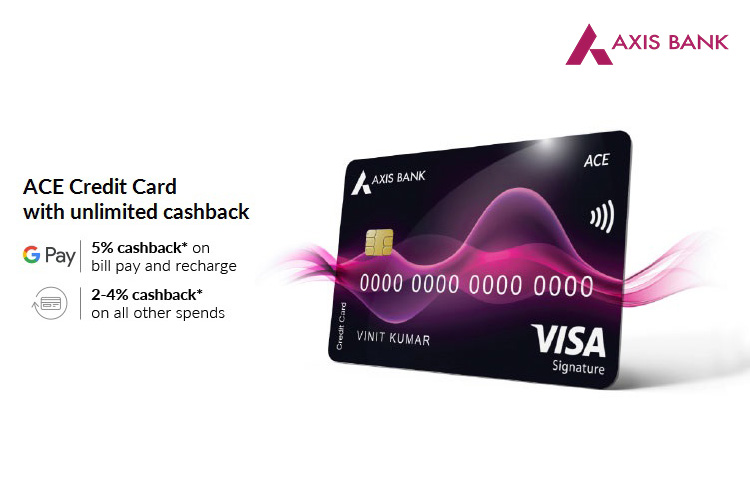

One of the best rewards credit cards available in India is the Axis Bank’s Ace Credit Card. It offers a variety of incentives, with the biggest reward at 2% on all purchases. Additionally, the card provides up to 5% reward on specific brands and spending types. The card is available for just Rs. 499 in annual fees. It works best for people who want to significantly increase the value of every dollar they spend.

Axis Bank ACE Credit Card is a good option if you’re in the market for a credit card that gives cashback on purchases. With this credit card, you may pay your bills and recharge your cell phone, DTH, and other electronic device with Google Pay and receive 5% cashback. On all other purchases, you’ll receive 2-4% cashback. The official website of Axis Bank is where you may submit an application for this credit card.

The majority of people believe that credit cards are utilized to take advantage of the credit limit. But you should be aware that most people choose a credit card to take advantage of interesting offers and bargains. Therefore, you have to look for the Axis Bank Ace Credit Card if you want to take advantage of the most recent credit card offers. You can perform EMI transactions with this credit card, so you should review its main features and advantages.

Benefits And Features Of The Ace Credit Card

You should be aware that using this card will enable you to significantly reduce your monthly spending. Your expenses will be reduced, and you can buy a variety of goods using this credit card. You can use this credit card for all of its features in regular transactions.

No Limit On Cashback

- Getting 5% Cashback when using this credit card to pay for your utility bills via Google Pay, including your electricity, gas, DTH, and other payments.

- Get 4% in flat Cashback when you use Swiggy.

- Take an OLA flight and receive 4% Cashback.

- On purchases made through Zomato, 4% Cashback is offered.

- The cashback rate for any other purchases made with this credit card is 2%.

- Cashback is unlimited in scope.

Access To Airport Lounges

- With your Axis Bank Ace Credit Card, you can enter the domestic lounges at airports four times without paying a fee.

- The number of free visits is capped at four per calendar year.

Waiver Of Fuel Surcharge

- Various Axis Bank Credit Card offers a 1% Fuel Surcharge Waiver at the filling stations.

- Up to 500 may be waived from the fuel surcharge per month.

Rules And Regulations

- The minimum transaction needed to qualify for the waiver is 400.

- The maximum transaction permitted for the waiver is $4000.

- There won’t be any Cashback on fuel purchases.

- Fuel-related GST charges are not refundable.

Dining Treats

According to this offer, you are qualified to receive a price reduction of as much as 20% at the 4000+ restaurants in India that Axis Bank has collaborated with.

Conversion To EMI

- On this credit card, you may convert purchases of $2500 or more into EMI transactions.

- You have a choice of a six-month period, a nine-month period, a twelve-month period, 18 months, or 24 months for the EMI term.

- On the outstanding balance, there is a monthly interest charge of 1.5 percent.

- On EMI transactions, there is going to be a single processing charge of 1.5% or $250, whichever is higher.

Axis Bank Ace Credit Card’s Fees And Charges

| Features | Details |

| Joining Fee | Rs. 499 |

| Annual Fee | Rs.499 |

| Complimentary Airport Lounge Access | 4 Access per year |

| Late Payment Fee | Nil, if the total payment due is up to ₹100 ₹100, if the total payment due is between ₹101 and ₹300 ₹300, if the total payment due is between ₹301 and ₹1,000 ₹500, if the total payment due is between ₹1,001 and ₹5,000 ₹600, if the total payment due is between ₹5,001 and ₹10,000 ₹700, if the total payment due is ₹10,001 and above |

| Overlimit Penalty | 3% of the overlimit account |

| Foreign Currency Transaction Charges | 3.5% |

Criteria For Eligibility And Documents Needed For An Ace Credit Card

- The candidate must be at least 18 years old.

- The applicant must be no older than 70 years old.

- The candidate must be an Indian citizen.

Documents

- Photocopy of a PAN card,

- Photograph in color,

- As evidence of income, use the most recent pay slip, bank statement, Form 16, or IT return copy.

- Proof of residence (any of the following)

- Passport and Driving Permit

- Aadhaar card, voter ID card

- Identity documentation, such as any of the following

- Passport and driving permit

- Aadhaar card, voter ID card

- Card PAN

How To Apply Online For An Ace Credit Card From Axis Bank?

The procedures you must take to apply for an Axis Bank ACE Credit Card are shown below.

- Visit the official Axis Bank website.

- Select “Explore Products” from the menu bar, then “Cards” from the drop-down menu, then “Credit Cards.”

- Locate the “Axis Bank ACE Credit Card” in the list and select “Explore More” if you want to learn more about the card; otherwise, select “Apply Now”.

- The “Apply Now” button will open a new page.

- Choose if you are a current client or a new customer there under “Click to Connect” and enter your information, including your name, state and city of residence, mobile number, income for the month, and professional details.

- Select the checkbox to give the bank’s representative permission to contact you about your credit card application.

- ‘Call Me’ should be clicked. You will be contacted by a bank representative who will help you with the credit card application process.

Offline

You can go to the nearby Axis Bank location with all the required paperwork. You will receive assistance from a bank person while you complete the Axis Bank ACE Credit Card application.

Click here: https://www.bankbazaar.com/credit-card/axis-bank-ace-credit-card.html

How To Contact Customer Service With Axis Ace Credit Card?

You can reach Axis Bank customer service online if you have any questions about the Axis Ace credit card request rank, Axis Bank Ace credit card yearly costs, Axis Ace credit card provides Ace credit card requirements for eligibility, or similar credit cards-related questions.

On the bank’s official website, you can talk with Axis AHA!, the virtual assistant known as Axis Bank, or type your questions in the “How can we help” box. For assistance, you can also phone 1860-500-5555 or 1860-419-5555 on the Axis Bank customer service line.

Click here: https://www.bajajfinservmarkets.in/credit-card/axis-bank-ace-credit-card.html

Comparison: Axis Bank Ace Credit Card Vs. Flipkart Axis Bank Credit Card Vs. ICICI Amazon Pay Credit Card

| Basis Of Difference | Axis Bank Ace Credit Card | Flipkart Axis Bank Credit Card | ICICI Amazon Pay Credit Card |

| Annual Fee | Rs. 400 | Rs. 500 | Nil |

| Base Cashback Rate | 2% | 1.5% | 1% |

| Accelerated Cashback | 5% reward on Google Pay bill payments and cellphone recharges Swiggy, Zomato, and Ola all provide 4% cashback 2% return on all other purchases | 5% cashback on Myntra, Flipkart, and 2GUD MakeMyTrip, PVR, Uber, and more: 4% cashback 1.5% return on all other purchases | For PRIME subscribers, Amazon offers 5% cashback Amazon offers non-Prime customers 3% cashback Amazon Pay Member Merchants receive 2% cashback |

| Lounge Access | 4 trips to domestic lounges per year | 4 trips to domestic lounges per year | Nil |

| Minimum Savings On Rs. 1 Lakh | Rs. 2,000 | Rs. 1,500 | Rs. 1,000 |

With the exception of Amazon and Flipkart, wherein both of those two cards offer more cashback and the Axis ACE offers only 2%, it is clear from the comparison above that the Axis Bank ACE Credit Card outperforms in the bulk of categories. However, the preferred option will vary based on your purchasing habits.

Axis Ace Credit Card Payment Options

For the purpose of paying off any outstanding debt, you must look at the Axis Bank Credit Card Payment choices. The banks permit cash payments as well, but there are additional expenses associated with it. As a result, you need to look at the online possibilities for paying credit card bills.

- Net Banking

- Mobile Application

- National Electronic Fund Transfer

- NACH Facility

- Cash and Cheque Payments

Axis Bank Ace Credit Card Limit

For all credit cards, the Axis Bank Ace Credit Card offers a respectable credit limit. The credit restriction is not set for every cardholder, though. Their revenue, their credit score, their connection to the bank, and several other elements influence it differently. A larger credit limit will be granted to people with good credit as opposed to those with bad credit. However, you can ask your card issuer to increase your credit limit over time.

Axis Bank Credit Card Balance Enquiry

You can check your credit card balance online through the mobile app or netbanking portal. But, you should register for these services and have your Axis credit card accounts linked. There are also multiple other methods you can avail to check the Axis credit card balance offline such as calling the customer care, visiting your nearest bank branch, sending an SMS, or swiping your credit card at an ATM.

Conclusion

The Axis Bank Ace Credit Card is a good option if you want an entry-level credit card with cashback rewards and routinely pay your bills and recharge your phone or DTH using Google Pay. In addition to offering free access to airport lounges, the credit account is also useful for customers who frequently purchase food online through Swiggy or Zomato.

FAQs

Will I always receive 2% back on purchases?

No, not all purchases qualify for cashback. Spending on fuel is one of them, as are EMI transactions, purchases that are changed to EMI, wallet loading actions, cash advances, paying off sums that are past due, and paying card fees along with additional card charges.

Do all Google Pay purchases receive 5% cashback?

No, you get 5% cashback on bill payments, cellphone, and DTH recharges. Keep in mind that only Android users can utilise the ‘pay with card’ feature to pay bills. Since iOS does not support the feature, iPhone users aren’t going to be able to take full advantage of the value-back which Axis Ace provides.

What kinds of transactions may I turn into EMIs?

Any transaction that costs more than Rs. 2,500 is able to be transformed into an EMI after the fact.

Does Axis Bank offer a discount at franchises or chains like KFC?

Franchise restaurants including KFC, TGI Fridays, Tossin Pizza, Chicago Pizza, and others are listed among the partner restaurants.

My credit card is gone. What ought I to do?

You must get in touch with the Axis credit card support team right away to request that your card be blocked if you lose it.

How can I acquire a new credit card for my destroyed one?

Through net banking, you can replace your credit card. You can also get in touch with the bank’s customer service representative and ask for a new credit card. To receive a new credit card, you can also go to the nearby Axis Bank.

When I use Google Pay to pay my bills, will I receive any cashback?

When utilizing the Ace Credit Card to pay bills with Google Pay, you will get 5% cash back.

Can I make EMIs out of my transactions?

Yes. Any transaction that is worth Rs. 2,500 or more can become an EMI.

What is the billing cycle of the Axis Bank Ace Credit Card?

The billing cycle is the duration between two consecutive statement generation dates. This billing cycle can be different for different cardholders.

Read More

I am an Undergraduate Student pursuing BA English Hons in KIIT University. My hometown is in Cuttack, Odisha. My hobbies include dancing and singing.