- Key Highlights of IDBI Euphoria World credit card:

- Benefits of IDBI Euphoria World credit card:

- Fee’s and Charges of IDBI Euphoria World credit card:

- Redeeming Rewards on IDBI Euphoria World credit card:

- Eligibility to apply for IDBI Euphoria World credit card:

- Required Documents for IDBI Euphoria World credit card:

- Credit cards similar to IDBI Euphoria World credit card:

- Apply for IDBI Euphoria World credit card:

- Contact IDBI Euphoria World credit card:

- Conclusion:

- F.A.Q’s:

- Read More:

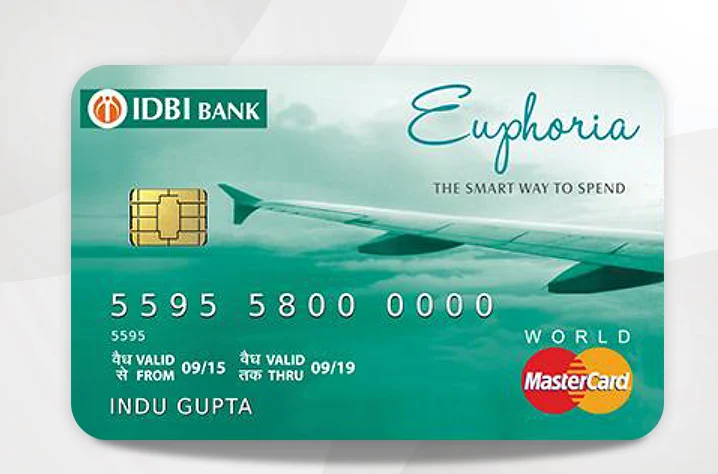

Finding the credit card that properly fits your lifestyle and interests in a world overflowing with credit card possibilities might be difficult. The IDBI Euphoria World Credit Card, on the other hand, drew our attention because it promised a euphoric experience with its varied variety of features and awards. We’ll examine the IDBI Euphoria World Credit Card’s features, benefits, and downsides in this review to help you decide if it’s the best option for you.

Key Highlights of IDBI Euphoria World credit card:

| Annual Fee | Rs. 1,499 (second year onwards) |

| Welcome Benefit | Within 60 days of obtaining the card, the first transaction with a minimum purchase of Rs. 1,500 earns you 4,000 joy points. |

| Suitable For | Rewards and Travel |

| Reward Points | 6 points for every Rs. 100 spend on joy |

Benefits of IDBI Euphoria World credit card:

Welcome Gift:

Spend at least Rs. 1,500 on your first transaction with your IDBI Bank Euphoria World Credit Card within the first 60 days to receive 4,000 Delight Points as a welcome gift.

Rewards:

With this card, you can earn 6 Delight Points for every Rs. 100 you spend on travel. Bookings for hotels, buses, trains, and other modes of transportation are included in travel costs. For all other purchases, you will get 3 Delight Points.

Renewal Benefit:

When you pay your annual fee, you will receive 2,000 Delight Points.

Fuel Surcharge Waiver:

If cardholders spend between Rs. 400 and Rs. 5,000 on fuel each month, they can get a 2.5% (maximum) fuel surcharge remission.

Insurance Coverage:

Take comfort in knowing that all of IDBI Bank Euphoria World Credit Card’s users are covered for up to Rs. 25 Lakh in case of an air travel accident.

Global Acceptance:

The international DBI Bank Euphoria World Credit Card is accepted at over 29 lakh merchant locations outside of India and at 9 lakh locations within the country.

Welcome Kit:

The bank will also send cardholders a digital Welcome e-Kit, which includes all the information they need to know about their card, including the agreement, Card Usage policy, Most Important Terms and Conditions (MITC), etc.

Interest Free Period:

An interest-free credit period of up to 48 days is available to cardholders.

Access to Lounges:

Select Indian airport lounges are easily accessible to IDBI Bank Euphoria World Credit Card holders.

Exclusive offers from MasterCard:

All IDBI Bank Euphoria World Credit Card holders are eligible for MasterCard promotions on travel, lodging, airport shopping, and more. Additionally, they can take advantage of the travel-related concierge services that MasterCard provides.

Fee’s and Charges of IDBI Euphoria World credit card:

| Type of Fees and Charges | Amount |

| Fee for joining | Rs.1,499 |

| Annual fee for the main card (this fee has to be paid from the 2nd year) | Rs.1,499 |

| Annual fee for the add-on card | No charge |

| Fee for card renewal | No charge |

| Interest charged on the revolving credit facility | 2.90% per month |

| Renewal fee for the add-on card | No charge |

| Interest charged on cash advance | 2.90% per month |

| Fee for cash advance transaction | 2.5% of the transaction fee (Minimum – Rs.300) |

| Overlimit charge | 2.5% of the overlimit amount (Minimum – Rs.500) |

| Fee for late payment | There is no fee if the amount is less than Rs. 100. There will be a charge of Rs. 100 for amounts between Rs. 100 and Rs. 500. There will be a fee of Rs. 400 applied to amounts between Rs. 501 and Rs. 5,000. There will be a charge of Rs. 500 for amounts between Rs. 5,001 and Rs. 20,000. If the amount is Rs. 20,000 or more, a fee of Rs. 700 will be applied. |

| Fee for Auto Debit Return | Rs.225 |

Redeeming Rewards on IDBI Euphoria World credit card:

- By logging into the IDBI Delight, you can redeem the Delight Points you accumulate.

- Your earned Delight Points can be redeemed for cinema tickets, gift cards, products, hotels, and cashback at a rate of 1 Delight Point = 0.25 Rupees.

- Excluding the month of accumulation, the earned Delight Points are valid for 3 years.

- For redemption against cashback, you must have a minimum of 4,000 Delight Points, and for redemption against other categories, you must have 1,000 Delight Points.

Eligibility to apply for IDBI Euphoria World credit card:

- The candidate must be an Indian citizen.

- Salary employees should be between the ages of 21 and 60.

- Individuals who are self-employed should be between the ages of 21 and 65.

- Add-on cardholders must be older than 18 years of age.

Required Documents for IDBI Euphoria World credit card:

- Recent picture.

- Identity proof options include a passport, an Aadhar card, a voter ID, a driver’s licence, and a PAN card.

- Utility bills, an Aadhar card, or a passport are acceptable forms of residence proof.

- Income documentation: Form 16 or the most recent three months’ worth of pay stubs (ITR)

Credit cards similar to IDBI Euphoria World credit card:

| Credit Card | Annual Fee |

| HDFC Regalia First | Rs.1000 |

| SBI SimplySave | Rs.499 |

| Citibank Cash Back | Rs.500 |

Apply for IDBI Euphoria World credit card:

You can provide your contact information on the bank’s website to apply for an IDBI Bank Euphoria World Credit Card, and a representative will get in touch with you.

To apply for this card, you can also go to the bank’s nearest branch.

Contact IDBI Euphoria World credit card:

Via Phone:

1800 425 7600 (Toll Free) or 022 – 4042 6013 (Call Charges Applicable)

Via E-mail:

customercare@idbi.co.in

Conclusion:

The IDBI Euphoria World Credit Card offers an enticing array of features and benefits, making it a compelling option for individuals who travel frequently and enjoy the perks of reward points. The accelerated rewards in specific spending categories and the welcome bonus add to its appeal.

However, it is crucial to weigh these advantages against the annual fee and eligibility criteria. If you meet the income and credit score prerequisites and are confident in your ability to manage credit responsibly, the IDBI Euphoria World Credit Card could be an excellent addition to your wallet.

F.A.Q’s:

How do I get in touch with IDBI Bank Euphoria World Card customer service?

To apply for an IDBI Bank Euphoria World Card, call the customer service toll-free number or send an email to the associated address.

What should I do if my IDBI Bank Euphoria World Credit Card is lost?

You must call the IDBI Bank 24×7 Customer Care number right away to report the loss of your IDBI Bank Euphoria World Credit Card. The bank will freeze your card and take care of any fraudulent transactions that were done after you reported the loss.

Is the fuel fee waiver I’ll get with my IDBI Bank Euphoria World Credit Card subject to a cap?

Yes, you are eligible for a monthly fuel fee waiver of up to Rs. 500.

What interest rate does IDBI Bank Euphoria World Cards offer?

The monthly interest rate offered by IDBI Bank Euphoria World Cards is 2.90%.

What are the IDBI Bank Euphoria World Card’s sign-up benefits?

When you spend Rs. 1500 or more during the first 60 days of obtaining your card, you’ll receive 4000 bonus Delight points as part of the IDBI Bank Royale Signature Card’s sign-up benefits.

What is the IDBI Bank Euphoria World Card’s annual fee?

The IDBI Bank Euphoria World Card has an annual cost of Rs. 1499.

What are the rewards points offered on an IDBI Bank Euphoria World Card?

The IDBI Bank Euphoria World Card offers the following reward points:

6 points for every 100 rupees spent on travel.

What kinds of benefits come with the IDBI Bank Euphoria World Card?

The Euphoria World credit card from IDBI Bank offers travel incentives.

What is the minimum salary required to qualify for a credit card?

An important consideration when choosing a credit card is salary. A person making, let’s say, Rs 50,000 a month qualifies for a different kind of card than someone making Rs 25,000 a month. The average annual income requirement for salaried individuals and self-employed individuals is between Rs. 1,44,000 and Rs. 25,00,000.

Read More:

I am a engineering student studying at Nimra college of engineering and technology(NCET)