- Key Highlights of Gild credit card:

- Benefits of Gild credit card:

- Redeeming Rewards on Gild credit card:

- Fee’s And Charges of Gild credit card:

- Eligibility to Apply for Gild credit card:

- Documents Required for Gild credit card:

- Apply for Gild credit card:

- Card and Transaction Limits:

- Conclusion:

- F.A.Q’s:

- Read More:

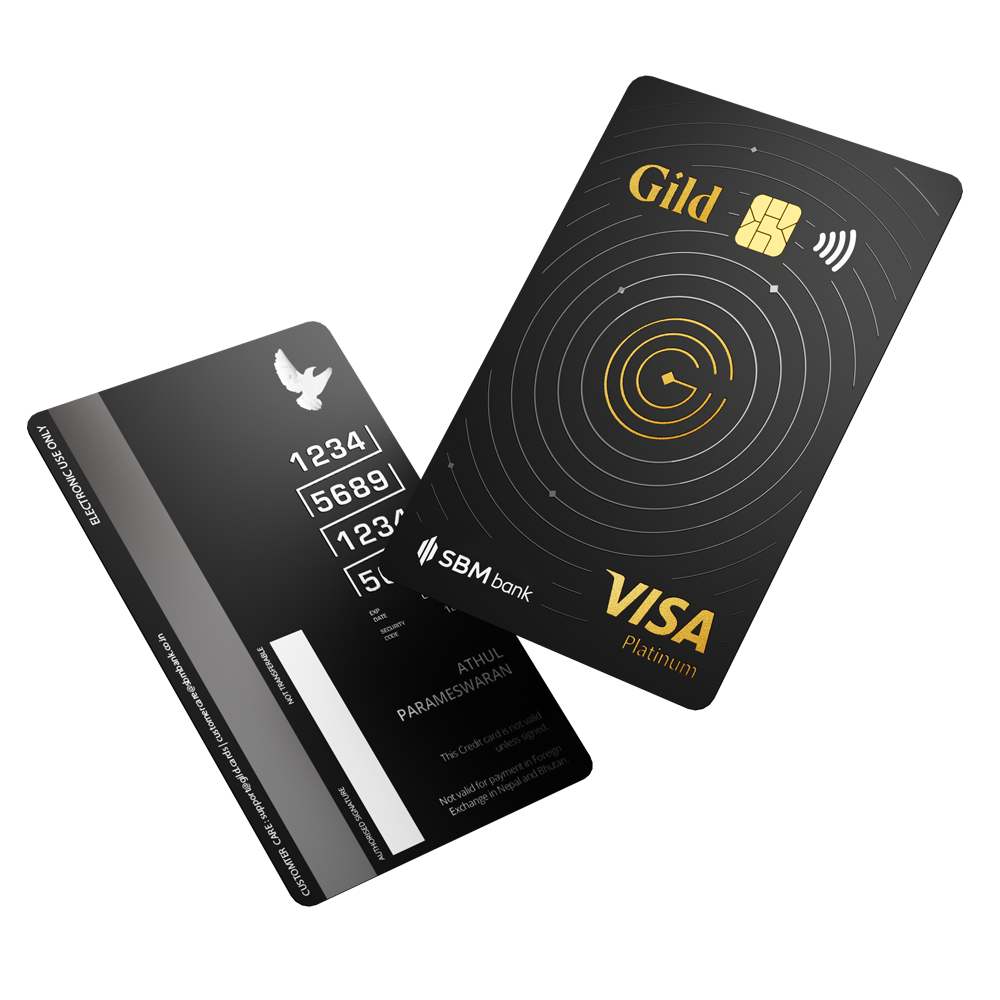

In today’s fast-paced world, credit cards have become an integral part of our financial lives. They offer convenience, security, and a wide range of benefits to cardholders. One credit card that has been making waves in the market is the Gild Credit Card. Known for its unique features and rewards program, the Gild Credit Card promises to be a game-changer for those seeking financial freedom. In this blog review, we will delve into the various aspects of the Gild Credit Card and discover whether it lives up to its promises.

Key Highlights of Gild credit card:

| Fee | Joining Fee Nil Renewal Fee Nil |

| Best Suited For | Shopping |

| Reward Type | Reward Points |

| Welcome Benefits | Free metal card holder |

Benefits of Gild credit card:

High Interest Rate:

- An FD-backed secured card with a high interest rate of 7.7% annually is the Gild card.

- You may make purchases without going over your FD because the money you deposited serves as your card’s spending cap.

- When using your Gild card to make purchases, you can spend up to 90% of the allowed amount without having your FD deposit reduced.

Earn Real Returns in Interest and Gold:

The Gild card is quite lucrative and provides rewards in the form of interest on FD deposits as well as rewards for card purchases in the form of virtual gold.

- A maturity interest of Rs. 1540 is paid on an FD deposit of Rs. 20,000 each year. As your credit limit is 90% of the FD, your maximum is Rs. 18,000

- Additionally, you receive 8% of your annual spending—or an average of 0.75% every transaction—back in Digital Gold each year.

- You can receive incentives in the form of digital gold worth about Rs. 1620 if you spend about Rs. 18,000 per month.

- As a result, the Gild card offers a about 16% annual return on investment.

Interest Free Period and Billing Cycle:

- On purchases made with their Gild card, cardholders receive a 45-day interest-free grace period.

- However, if there are any unpaid balances from your previous month’s card statement, the interest-free credit term is not available.

- Additionally, the Gild card has a monthly billing cycle that you can adjust once as long as you do not have any past-due balances.

Exclusions on Petals Earning

- Transfers of money and wallet reloading.

- Money orders, traveler’s checks, and foreign exchange.

- casinos and lotteries run by the government.

- Horse and dog racing.

- Dealers and brokers in securities.

- Associations for politics.

- Lottery tickets, bets, gambling establishments, chips, etc.

Check more in the official website of Gild credit card.

Redeeming Rewards on Gild credit card:

Petal Program – Gold Reward Points:

- Every time you use your Gild card for a POS or online transaction, you can get 0.75% of your money back as Petals.

- The Petals can then be used to redeem benefits such as rebates, digital gold, or other incentives.

- Through a collaboration with Safegold, the awards are distributed as Digital Gold. There is no incentive redemption fee while using Petals, and 1 Petal is equal to 1 Rupee in digital gold.

- Your earned Petals never expire and are simple to redeem with just one click.

- Without having to spend them elsewhere, you can simply redeem them and receive digital gold.

Fee’s And Charges of Gild credit card:

| Spend based Waiver | NA |

| Rewards Redemption Fee | Nil |

| Foreign Currency Markup | 2.5%Markup |

| Interest Rates | 30% p.a. |

| Fuel Surcharge | Nil |

Eligibility to Apply for Gild credit card:

To qualify for the Gild card, the candidate must meet the following requirements:

- The applicant must be between the ages of 18 and 60.

The candidate must be an Indian national. - All Indian pin codes, with the exception of those for the North-East and Jammu & Kashmir, can order the card.

The card does not require a credit check, and applicants are guaranteed to receive it when they make a fixed deposit. The card also aids in establishing a respectable credit history and credit score.

Documents Required for Gild credit card:

- Aadhar card

- Pan card

Apply for Gild credit card:

- You must open an FD account in order to receive a Gild credit card, and the issuance of the card is contingent upon the successful opening of the FD. Without an FD, you cannot independently obtain the card. Through the Gild website or mobile app, the fixed deposit must be made in the manner required by the bank.

- To apply for the card, you must have a current PAN card and Aadhar card. Several states, including Assam, Ladakh, Jammu & Kashmir, Sikkim, Manipur, Tripura, Nagaland, Arunachal Pradesh, and Meghalaya, do not currently offer the card.

Card and Transaction Limits:

| Details | Limit |

| Credit | 90% of FD |

| Daily Spending | Up to Rs.2 lakh |

| Maximum Cash Transaction | 50% of FD |

Conclusion:

The Gild Credit Card brings a refreshing approach to the credit card landscape, combining elegance, innovation, and security. With its sleek design, impressive features, rewarding rewards program, and unparalleled security measures, the Gild Credit Card offers a golden opportunity for individuals seeking financial freedom. Whether you’re a frequent traveler, a savvy investor, or simply looking for a reliable credit card, the Gild Credit Card is worth considering. Embrace the future of credit cards and unlock a world of possibilities with the Gild Credit Card.

F.A.Q’s:

What are the Gild credit card’s annual and initiation fees?

The SBM Bank Gild credit card is a lifelong no-fee card that does not charge the cardholder a joining or renewal fee. To obtain the card and utilise it for daily purchases, you must open a savings account with a minimum balance of Rs. 10,000. The card offers up to 16% annual returns on your investment, which includes up to 8% back in the form of digital gold and 7.7% interest on the deposit amount.

What is the Gild credit card’s credit limit?

You are given a credit limit on the Gild credit card that is 90% of your FD amount. You will receive a credit limit of Rs. 45,000 on your Gild card if your FD deposit is for Rs. 50,000.

How does this card’s rewards system operate?

When you make a POS or online purchase with the Gild credit card, you receive 0.75% back as Petals. The Petals can be exchanged for prizes like cash back, digital gold, or other options. With Safegold as the issuing partner, 1 Petal is equal to 1 Rupee in terms of digital gold. On your earned Petals, you are not required to pay any reward redemption fees.

Can I use my Gild credit card to make cash withdrawals?

Yes, you can use your Gild credit card to withdraw cash. There is a maximum cap of Rs. 10,000 on cash withdrawals made with the card, and there is a cash advance fee of Rs. 125 per transaction.

Who may one apply for a Gild credit card?

To qualify for the Gild credit card, you must meet the following criteria:

The candidate must be between the ages of 18 and 60.

The candidate needs to be an Indian national.

The North Eastern states, including Jammu and Kashmir, do not yet have access to the card.

Anyone who makes a fixed deposit is eligible for the card, which does not require a credit check.

Do Gild Credit Card deals exist?

Yes, Gild Credit Cards offers a variety of promotions for this Visa Platinum card throughout the food, travel, entertainment, fashion, and other categories.

Is Gild available as an unsecured credit card or without FD?

Gild cards are currently not offered without FD or as an unsecured credit card. For consumers applying for a Gild credit card, the FDs and the credit card are inseparable items.

How do I make my Gild Credit Card active for internet purchases?

To quickly obtain the virtual card, download the Gild app from the Apple Store or Google Playstore and finish the application process. Activate the capabilities that facilitate online activities like online transactions after getting the card by selecting ‘Manage Card’.

How do I change the settings or preferences on my Gild credit card?

The ‘Manage Card’ option allows you to change the credit card settings or preferences by limiting the number of transactions you may make each day, disabling transactions on different platforms, or blocking cards.

How may any transactional irregularities be reported?

You can use the Gild app to report any transaction-related errors by going to the transaction tab, selecting “Raise an issue,” and then selecting the type of issue.

Read More:

I am a engineering student studying at Nimra college of engineering and technology(NCET)