- Key Highlights of BPCL SBI credit card:

- Benefits of BPCL SBI credit card:

- Rewards Redemption on BPCL SBI credit card:

- Fee’s and Charges of BPCL SBI credit card:

- Eligibility to Apply for BPCL SBI credit card:

- Required Documents for BPCL SBI credit card:

- Comparison:

- Apply for BPCL SBI credit card:

- Check BPCL SBI credit card:

- Contact BPCL SBI credit card:

- Conclusion:

- F.A.Q’s:

- Read More:

The BPCL SBI Credit Card stands out as a unique offering that caters specifically to fuel-conscious individuals. Credit cards are now a necessary tool for managing our finances and taking advantage of a number of benefits in today’s fast-paced society. In this blog post, we will delve into the features, rewards, and benefits that make the BPCL SBI Credit Card a valuable companion for your wallet.

Key Highlights of BPCL SBI credit card:

| Best Suited For | Fuel |

| Joining Fee | Rs. 499 |

| Annual Fee | 499 rupees (reversed after spending 50,000 rupees in a year) |

| Welcome Benefit | 2,000 additional reward points upon activation, equal to Rs. |

| Best Feature | 13X reward points on fuel purchases at BPCL petrol pumps |

Benefits of BPCL SBI credit card:

Fuel surcharge benefits:

- Up to Rs. 100 in monthly surcharges are waived at all BPCL fuel pumps in the nation.

- 70 litres less fuel are used per year.

- Valueback of 4.25% (13X* points) on fuel purchases made at BPCL petrol stations. 1300 Reward Points maximum each billing period.

Reward point benefits:

- Every Rs. 100 spent on groceries, meals, movie tickets, and department shop purchases earns 5x reward points.

- On non-fuel purchases, one reward point is earned for every 100 rupees.

Worldwide Acceptance:

- Card is accepted at more than 24 million establishments worldwide.

- The card is used at any MasterCard or Visa retailer.

Easy Bill Pay:

- Utility payments are simple using the Bill Pay feature.

Add-on Credit Card:

- Cards for family members are offered as add-ons.

Balance Transfer:

- Balance transfers from other credit cards to the BPCL SBI card are permitted, and the card offers simple EMI payments and lower interest rates.

Flexipay Benefits:

- Transactions above Rs.2,500 can be converted into easy EMI with FlexiPay.

Other Benefits:

- Available checks and draughts against available cash.

- Simple account maintenance via website and mobile app.

You can check more in SBI official website.

Rewards Redemption on BPCL SBI credit card:

Here are the steps to redeem reward points on BPCL SBI Credit card

Via Online:

- Step 1: Enter your customer ID and password to access the SBI Card portal.

- Step 2: Click “Redeem Rewards” in the “Rewards” section.

- Step 2:Filter the reward points by city and category .

- Step 4: Look through the “Rewards Catalogue” items and choose one of your preference.

- Step 5: To confirm, click “Redeem Now.”

Via Offline:

By dialling the SBI credit card customer service number, you can redeem credit card reward points offline. You can get assistance from the customer service representative with the redemption process. Either choose the ‘Points+Pay’ option, where you can use your points to buy the item in full while paying the balance with a credit card, or you can pay the entire cost of the item in points.

Fee’s and Charges of BPCL SBI credit card:

| Type of Fee | Amount |

| Annual Fee | Rs.499 |

| Renewal Fee | Rs.499 |

| Finance Charges | 3.35% maximum monthly. |

| Add-On card fee | Nil |

| Cash advance fee | 2.5% of the amount withdrawn or Rs.500 – Domestic ATMs. 2.5% of the amount withdrawn or Rs.500 – International ATMs. |

| Finance Charges | 3.50% per month or 42% per annum. |

| Payment dishonor fee | 2 percent of the total payment; a minimum of Rs. 450. |

| Statement request | Rs.100 per statement (more than 2 months old). |

| Cash payment fee | Rs.250. |

| Late payment | From Rs.0 to Rs.500 – Nil More than Rs.500 up to Rs.1,000 – Rs.400 More than Rs.1,000 up to Rs.10,000 – Rs.750 More than Rs.10,000 up to Rs.25,000 – Rs.950 More than Rs.25,000 up to Rs.50,000 – Rs.1,100 More than Rs.50,000 – Rs.1,300. |

| Cheque payment fee | Rs.100. |

| Over limit fee | 2% of any amount beyond the limit, with a minimum of Rs. 600. |

| Rewards redemption fee | Rs.99. |

| Foreign currency transaction | 3.50%. |

Eligibility to Apply for BPCL SBI credit card:

The exact eligibility criteria for the BPCL SBI Credit Card depend on various parameters. However, the basic criteria for eligibility include the following:

- Minimum age: 21 years

- Maximum age: 70 years

- Occupation: Salaried or self-employed

- Other factors: A good credit and a consistent source of income.

Required Documents for BPCL SBI credit card:

| Proof of Identity | PAN Cards, Aadhaar Cards, Driver’s Licences, Passports, Voter IDs, Person of Indian Origin Cards, Job Cards Issued by NREGA, Overseas Citizens of India Cards correspondence from the UIDAI |

| Proof of Address | Aadhaar card, Driver’s License, Passport, Utility Bill not more than 3 month’s old, Ration Card, Property Registration Document, Person of Indian Origin Card, Job card issued by NREGA, Bank Account Statement or any other government approved address proof. |

| Proof of Income | Most recent one or two pay stubs, no older than three months. |

Comparison:

BPCL SBI credit card v/s BPCL SBI card octane

| Basis | BPCL SBI credit card | BPCL SBI card octane |

| Fee | Joining Fee Rs. 499 (plus applicable taxes) Renewal Fee Rs. 499 (plus applicable taxes) | Joining Fee Rs. 1,499 (plus applicable taxes) Renewal Fee Rs. 1,499 (plus applicable taxes) |

| Best Suited For | Fuel | Fuel |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | On payment of the membership cost, you will receive 2,000 Activation Bonus Reward Points worth Rs. 500 (credited 20 days after joining fee payment). | 6,000 additional RPs as a welcome bonus, and the membership is renewed annually (as long as the annual cost is paid). |

BPCL SBI credit card v/s SBI card Pulse:

| Basis | BPCL SBI credit card | SBI card Pulse |

| Fee | Joining Fee Rs. 499 (plus applicable taxes) Renewal Fee Rs. 499 (plus applicable taxes) | Joining Fee Rs. 1,499 (plus applicable taxes) Renewal Fee Rs. 1,499 (plus applicable taxes) |

| Best Suited For | Fuel | Shopping |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | On payment of the membership cost, you will receive 2,000 Activation Bonus Reward Points worth Rs. 500 (credited 20 days after joining fee payment). | A Noise ColorFit Pulse Smart Watch valued at Rs. 5,999, a free Fitpass Pro subscription, and a free Netmeds First subscription. |

BPCL SBI credit card v/s SBI SimplySAVE credit card:

| Basis | BPCL SBI credit card | SBI SimplySAVE credit card |

| Fee | Joining Fee Rs. 499 (plus applicable taxes) Renewal Fee Rs. 499 (plus applicable taxes) | Joining Fee Rs. 499 (plus applicable taxes) Renewal Fee Rs. 499 (plus applicable taxes) |

| Best Suited For | Fuel | Shopping |

| Reward Type | Reward Points | Reward Points |

| Welcome Benefits | On payment of the membership cost, you will receive 2,000 Activation Bonus Reward Points worth Rs. 500 (credited 20 days after joining fee payment). | 2,000 reward points (worth 500 rupees) after spending at least 2,000 rupees within the first 60 days after card activation. |

Apply for BPCL SBI credit card:

- Go to the SBI Card website.

- To apply, select “Personal > Credit Cards”

- Select ‘Travel & Fuel Cards’ to view the BPCL SBI Card on a new page with a variety of categories.

- To access the application page, click the ‘Apply Now’ button beneath the card details.

- Complete the necessary fields and select “Next Step.”

- Following receipt of the data, the bank will decide right away if you qualify for the card.

- Your credit limit will be visible online if you qualify for the card, which indicates that your online application has been accepted.

- Bank staff will contact you within the next two working days to inform you of the required documents and set up a time for you to pick it up.. Once the paperwork is received,the bank will take upto 21 days to process your application.

Check BPCL SBI credit card:

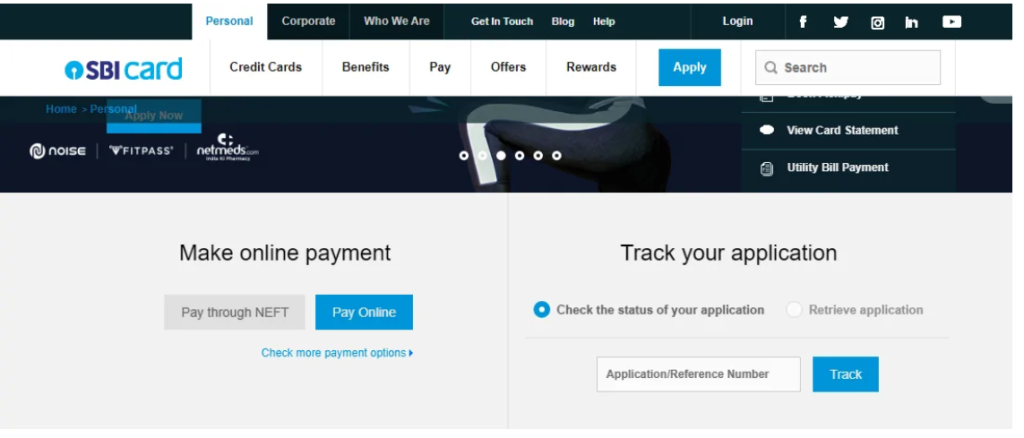

Via Online:

Through the bank’s official website, you can check the progress of your SBI credit card application. All you have to do is go to www.sbicard.com, which is the SBI Card’s official website. Enter your application/reference number as displayed in the figure below under the “Track your application” section:

The application status of your credit card will then be displayed on the screen once you click ‘Track’.

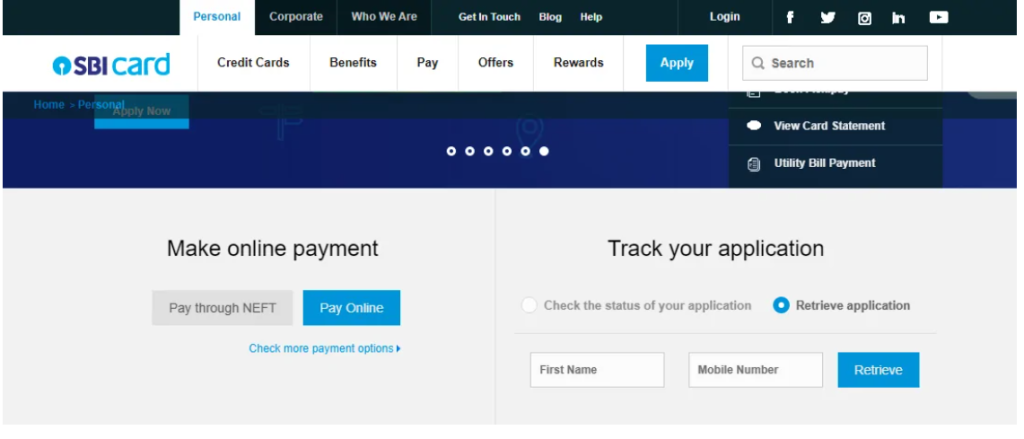

However, you can still access the information by following the procedures below if you don’t have the application or reference number:

Go to the SBI Card website and click “Retrieve application” in the “Track your application” section, as illustrated in the illustration below:

After that, click “Retrieve” and then input your name and phone number. Make sure you correctly enter both details. Your application/reference number will then be shown on the page, which you can use to check the status of your SBI credit card application.

Via Offline:

You can check the progress of your SBI credit card application offline in addition to online by calling the bank’s 24-hour hotline. The SBI credit card customer service numbers are listed below:

1860-180-1290 (39020202) (STD Code)

The customer support representative will need your application/reference number to check the status of your application, so keep it handy.

Contact BPCL SBI credit card:

Via phone:

1860-180-7777

Via E-Mail:

gm.customer@sbi.co.in.

Conclusion:

In a world where fuel expenses can often put a strain on our budgets, the BPCL SBI Credit Card emerges as a beacon of financial relief. With its fuel-centric rewards program, welcome bonus, and a wide array of discounts, this credit card provides a holistic and rewarding experience. So, whether you’re a frequent traveler or a daily commuter, this card is a valuable addition to your wallet, helping you save on fuel costs while enjoying a range of benefits.

F.A.Q’s:

Where can I submit an application for a BPCL SBI Credit Card?

In the State Bank of India’s official website, you can apply for the BPCL SBI Credit Card.

What benefits do I get when I use my BPCL SBI Credit Card for fuel?

You are exempt from paying up to Rs. 100 in monthly gasoline surcharges. At BPCL petrol stations, you can receive accelerated reward points at a rate of 13x coupled with a monthly remission of the fuel surcharge.

What is the BPCL SBI Credit Card’s interest fee duration?

For the BPCL SBI Credit Card, the interest fee term is 20–50 days.

What is the BPCL SBI Credit Card Over Limit Fee?

The BPCL SBI Credit Card has a 2.5% over limit fee.

Is there a required minimum number of reward points to redeem with a BPCL SBI credit card?

No, the BPCL SBI Credit Card does not have a minimum requirement for Reward Points to be redeemed.

What kinds of documents are required to apply for a BPCL SBI credit card?

You will require identification documentation, a PAN card, a pay stub, evidence of residency, and a current passport-size photo.

How long does it take the bank to complete a BPCL SBI Credit Card application?

The bank will process your application for the BPCL SBI Credit Card in 3 weeks (21 days) if all of the given documentation are in order.

How do I spend the points on my SBI BPCL Credit Card at the petrol station?

Your reward points can be immediately exchanged for free petrol at more than 1,200 authorised BPCL retail locations nationwide or with BPCL fuel coupons. The validity of the vouchers is six months from the date of issuance. Additionally, partial redemption is not allowed.

Can I transfer my unpaid balance from a credit card issued by another bank to a credit card issued by SBI BPCL?

Yes, the BPCL SBI Card includes a ‘Balance Transfer’ service that allows you to transfer the remaining balance from any other bank’s credit card to your SBI Card. You can do this by getting in touch with the bank and discussing your issue with a representative.

Which category of spending will earn me 5X rewards?

Using your BPCL SBI Card in grocery stores, department stores, theatres, and restaurants earns you 5X Reward Points.

What is the BPCL SBI card’s interest rate?

The BPCL SBI Credit Card has an interest rate of 3.5% per month (or 42% yearly).

Do I receive 13X Rewards Points at all fuel stations for fuel purchases?

No, only fuel purchases made at BPCL petrol stations qualify for the 13X Reward Points.

Read More:

I am a engineering student studying at Nimra college of engineering and technology(NCET)