- Fees And Charges Of Axis Bank Magnus Credit Card

- Features And Benefits Of Axis Bank Magnus Credit Card

- Axis Bank Magnus Credit Card Reward Points

- Milestone Benefits

- Eligibility Criteria For Axis Bank Magnus Credit Card

- Should You Get Axis Bank Magnus Credit Card?

- How To Apply For The Axis Bank Magnus Credit Card?

- Axis Bank Magnus Credit Card Payment Options

- Axis Bank Magnus Credit Card Limit

- Similar Credit Cards

- How To Reach The Customer Care Of Axis Bank Magnus Credit Card?

- Axis Bank Magnus Credit Card vs HDFC Infinia Credit Card vs HDFC Diners Club Black Credit Card

- Axis Bank Reserve Credit Card Vs. Axis Bank Magnus Credit Card

- Conclusion

- FAQs

- Read More

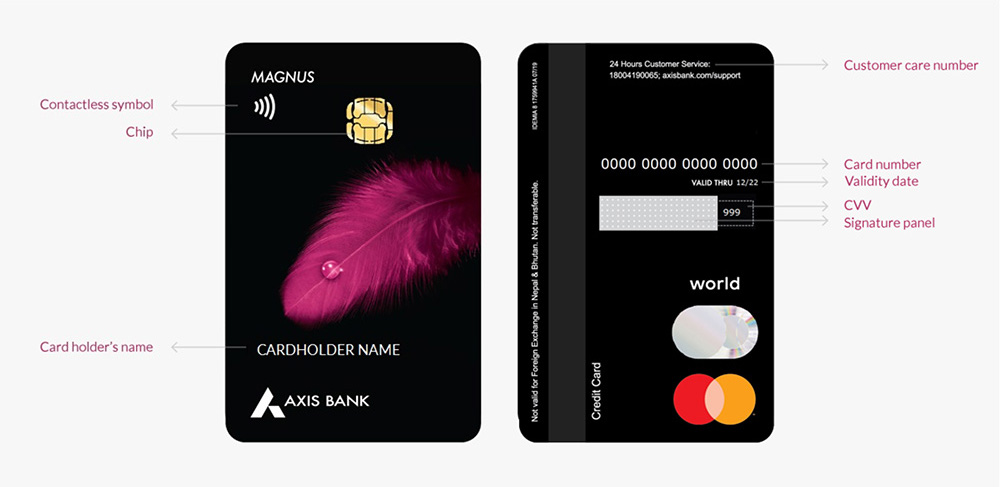

The Axis Magnus Credit Card is a high-end credit card with powerful perks in numerous categories. The card compares favourably to other well-known premium and super-premium cards, such HDFC Diners Club Black and HDFC Infinia, and in some categories even outperforms them. Axis Magnus provides substantial advantages in the travel and rewards sectors, as well as discounts on entertainment and restaurants. The fact that the card is also available in metal form ups its premium status. Any Indian resident who earns at least Rs. 18 lakh annually is eligible to apply for this credit card.

One of the most advantageous and sought-after credit cards in Axis Bank’s lineup is the Magnus Credit Card. The bank’s super-premium card is intended for wealthy earners who desire the luxury of living a lavish lifestyle.

The bank’s super-premium card is intended for wealthy earners who desire the luxury of living a lavish lifestyle. Although there is a 10,000 rupee joining charge, it offers numerous luxurious travel, leisure, dining, and insurance perks.

Airport domestic and international lounge access is included with cardholders’ 24-hour concierge service. International transactions are also available to premium customers for a reasonable 2% Forex Markup cost.

Additionally, there are no fees associated with cash withdrawals on the card (interest fees still apply). By spending a minimum of 15 lakh within the year leading up to your anniversary, you can waive the substantial annual fee associated with the card and save Rs. 10,000. To learn more about the super-premium Magnus credit card, keep reading our review.

Fees And Charges Of Axis Bank Magnus Credit Card

| Fees and Charges | Amount |

| Annual Fees | Rs. 10,000 |

| Finance Charges | 2.5% per month |

| Fees for Cash Withdrawals | Not Applicable |

| Overlimit charges | The greater of 2.50% of the amount exceeding the limit or Rs. 500 |

| Late Payment Fees | Varies depending on the entire amount still owing, from Rs. 300 to Rs. 600 |

| Fees for Foreign Transactions | 2% of the amount |

Features And Benefits Of Axis Bank Magnus Credit Card

Travel And Stay Benefits

| Benefit type | Benefit | Notes |

| Welcome/Annual Benefit | A free domestic flight ticket OR a gift card to Tata Cliq worth Rs. 10,000 | 1)Receive through SMS from the bank. 2) Visit the bank website and sign in to select 3) Use the service within six months of getting the SMS. 4) A minimum of 10 days should pass before purchasing a flight ticket 5) The Tata Cliq gift card has a 12-month expiration date. |

| Airport Concierge Services | 8 free VIP services are available at the airport. Complimentary porter services, immigration, security, and check-in without hassle | (1) Use the bank’s official website to access the services. (2) A maximum of eight VIP airport services may be used annually. (3) Ticket reservations must be made at least 48 hours in advance. (4) Applicable to both domestic and international airports. 5) Acceptable at 29 Indian airports |

| International Lounge Access | 1) Unlimited access to international lounges 2) Eight visitors every year | 1)Free and unrestricted access 2) The welcome pack includes the priority pass. 3) In order to use the guest services, the principal cardholder must be present. 4) As long as the credit card is not blocked, the priority pass will function. |

| Domestic Lounge Access | 29 Indian airports may be visited indefinitely | – |

Lifestyle And Entertainment Benefits

| Benefit type | Benefit | Notes |

|---|---|---|

| Bookmyshow Benefits | Get Rs. 500 off the second ticket when you purchase one for a movie or other event. | 1) Offer good for a maximum of five reservations per month. 2) To take advantage of the deal, follow these steps: a) open the BookMyShow app; b) choose the movie and seats as normal; c) go to the payments page; d) check the box next to “unlock offers or unlock promo codes”; e) enter your credit card information; and f) take advantage of the offer. |

| Dining Benefits | Get discounts of up to 20% at more than 4000 restaurants in India. | – |

| Extraordinary weekends | The weekend deals we’ve hand-selected for you to choose from. 1). Schedule golf instruction 2)Unique Airport Concierge Services 3) Reserve airport shuttle services | Visit the bank’s official website to take advantage of this offer. You can also phone 1800 103 4962. |

Health And Wellness Benefits

| Benefit type | Benefit | Notes |

|---|---|---|

| Insurance Benefits | Participate in a lost card liability programme, purchase protection, and more. | 1) Purchase protection up to Rs. 2 lakhs; 2) Lost card liability up to your card’s credit limit 3)Credit Shield up to Rs. 5 Lakhs 4) Air accident insurance up to 450 lakhs rupees valid until 31/10/225) Up to 500 USD for baggage loss/delay and personal document loss |

| Medical Concierge program | Health counselling, oncology care, virtual teleconsultations, home quarantine care, and more | To use the services, call 1800 103 4962. |

| Second Medical Opinion | Get medical advice from international experts and professionals. | 1)To use the services, call 1800 103 4962. 2) Actual costs for this service are charged. |

| Preventive Healthcare | Offers on their proactive health care packages and more from Dr. Lal Path Lab and Metropolis | 1) To use the services, call 1800 103 4962. 2) This service is offered for a little time only. |

| Global Travel and Medical Assistance | 1) Travel health guidance 2) Pre-trip details 3) Translation services 4) Immunization 5) Information on visa requirements 6) Telemedicine guidance | 1) To use the services, call 1800 103 4962. 2) To qualify, you must spend no more than 90 days per trip outside of your nation of residence. 3) This service is depending on access. |

Terms And Conditions

- After paying the yearly or joining fee, the primary cardholder will become eligible for the discounted flight offer.

- The Cardholder will get a message from the bank confirming their flight reservation.

- When the communication is received, the flights must be reserved within six months.

- A maximum amount of ₹10000 is capped for booking the domestic flight.

- Bookings must be made 10 days before the intended departure date.

- A transaction of ₹1 has to be made for the authentication.

- Before 48 hours of the service time, VIP Assistance must be reserved.

- To obtain 4 extra international lounge accesses, the cardholder must have spent ₹7 lacs in the preceding year.

- A transaction of 25 will be conducted for authentication in the event of domestic lounge access, which will be afterwards reversed.

- The Oberoi offers will only be eligible in the online booking transactions.

Discounts On Staying At Oberoi Hotel

Get a flat 15% discount and a free room upgrade when you stay at one of the Oberoi Hotels. Please present your Axis Bank Magnus Credit Card when making payment for your order and during the checkout process. The free upgrade is contingent upon availability.

List Of Reputed International Hospitals

The following hospitals are included in the offer on the Axis Bank Magnus Credit Card.

- Massachusetts General Hospital

- McLean Hospital (Psychiatric Services)

- Massachusetts Eye and Ear Infirmary

- The Spaulding Rehabilitation Hospital

- Dana-Farber Cancer Institute

- The Brigham and Women’s Hospital

Global Travel And Assistant Services

- Information Related to Visa and Inoculation

- Reference for the Interpreter

- Advice and Assistance in the case of lost documents.

- Legal Referrals

- Translation Assistance

- Urgent Document Delivery

- Arranging Transportation and Accommodation for family members

- Telephonic Medical Assistance

- Medical Service

- Arranging Hospital Admission

- Emergency Medical Evacuation

- Arrangement of Accommodation

Axis Bank Magnus Credit Card Reward Points

- For every Rs. 200 you spend using the card, you receive 12 Axis EDGE REWARDS Points.

- On expenditures for travel made with Travel Edge, you receive 5x Edge Reward Points.

- Edge Rewards for rental transactions accrue only up to transactions of Rs. 50,000 per month

- On the Axis Bank Grab Deals website, you can receive up to 45x Reward Points on transactions from different brands. Per customer, a maximum of 10,000 EDGE Reward Points may be earned each month. For a limit of Rs. 10,000 each month, you can now purchase Amazon/Flipkart certificates from EDGE REWARDS.

- In addition, if you spend more than Rs. 1 lakh in a calendar month, you will receive 25,000 bonus EDGE Reward Points.

- On Gyftr, you may receive up to 10x Reward Points in addition to fantastic discounts. The maximum quantity of reward points you may acquire through the Gyftr portal has no upper limit. Only Rs. 10,000 value of Amazon gift cards can be bought per month by cardholders via the Gyftr service.

Reward Points Accural

| Spends Area | Multiplier | Reward Points Earning Rate | Capping |

| All Spends* | 1X | 12 Edge Reward Points/ ₹200 | NA^ |

| Gift Edge | Up to 10X | Up to 120 Edge Reward Points/ ₹200 | NA |

| Travel Edge | 5X | 12 Edge Reward Points/ ₹200 | NA |

| Grab Deals | Up to 40X | Up to 480 Edge Reward Points/ ₹200 | 10,000 ER Points/Customer ID/Month |

- *Except for Fuel, Wallet Loads, and EMI.

- The maximum incentives on coverage and rental expenditures each transaction are 1,000,000 and 50,000.

- Three years from the beginning of accrual, Edge Rewards expire.

Reward Redemption

On the Axis EDGE REWARDS conversion portal, you can exchange your Axis EDGE REWARDS Points for quick coupons, presents, electronics, clothing accessories, and more. Edge Reward = 0.20 Re per edge.

You can also Transfer EDGE REWARDS Points earned to Partner Airlines/Hotels Rewards Program including Club ITC, Marriott Bonvoy, Etihad Guest, KrisFlyer, United, Turkish Miles&Smiles, and much more at a ratio of 5:4.

| Redemption Options | Value Per ER Point | Reward Rate (1X) |

| Cash | 20p | 1.2% |

| Travel Edge Redemption | 20p | 1.2% |

| Gift Vouchers | 20p (Amazon) to 40p (MultiBrand) | 1.2% to 2.4% |

| Transfer Partners | Minimum 80p | Minimum 4.8% |

Milestone Benefits

Axis Magnus additionally provides 25,000 eDGE Reward Points when monthly spend reaches Rs. 1 Lakh in addition to the normal reward earning opportunities. The value of these 25,000 points is Rs. 5,000. Axis Magnus is a fantastic choice for big spenders because of this functionality.

Transfer Rewards Points to Loyalty Programmes for Airlines and Hotels

Cardholders have the option to convert their Axis edge Reward Points into Air Miles or Hotel Loyalty Points at a ratio of 5:4. Accordingly, users will receive 4 loyalty points upon conversion for every 5 eDGE Reward Points.

Eligible flights and hotels are:

- Air France-KLM

- Marriott International

- Vistara

- ITC

- SpiceJet

- Air Asia

- Ethiopian Airlines

- Etihad Airways

- IHGR Hotels and Resorts

- Qatar Airways

- Singapore Airlines

- Turkish Airlines

- United Airlines

Comparing Reward Earnings on Axis Magnus with HDFC Diners Club Black Credit Card and HDFC Infinia

| Category | Spends (in INR) | Points – Axis Magnus | Points – HDFC Diners Club Black | Points – HDFC Infinia |

| Grocery | 15,000 | 900 | 500 | 500 |

| Apparel | 20,000 | 1,200 | 666 | 666 |

| Travel | 20,000 | 1,200 | 666 | 666 |

| Dining | 10,000 | 600 | 333 | 333 |

| Healthcare | 15,000 | 900 | 500 | 500 |

| Fuel | 15,000 | 900 | 500 | 500 |

| Others | 5,000 | 300 | 166 | 166 |

| Total | 1,00,000 | 6,000 | 3,331 | 3,331 |

When they hit their monthly goal of Rs. 1 Lakh, in addition to the 6,000 reward points, Magnus users will also receive 25,000 extra reward points (worth Rs 5,000). Therefore, they will earn 31,000 points in total rewards. The customer will receive 24,800 loyalty points when they transfer it to the flight/hotel loyalty programme (5:4 ratio).

Other Benefits

- Enjoy a 1% fuel surcharge waiver on purchases between $400 and $4000.

- Get 12 Axis eDGE Reward Points for every 200 spent.

- Get round-the-clock assistance with reservations for flights, restaurants, and other services.

- Earn two times as many Axis eDGE Reward Points when using MakeMyTrip, Yatra, Goibibo, and other services.

Eligibility Criteria For Axis Bank Magnus Credit Card

| Age | 18 – 70 Years |

| Residence | Indian |

| Income | Rs. 18 lakh p.a and above |

Both Self-employed and Salaried

- Completed application form

- Passport-size photographs

- Identity documentation, such as a copy of a passport, PAN, or Aadhaar

- Proof of residence (utility bills, driving license, PAN, Aadhaar, etc.)

Salaried- Income proof

- Latest salary slips

- Form 16

- Bank statements

Self-employed- Income Proof

- Income proof

- Statement of accounts

- Proof of business

Should You Get Axis Bank Magnus Credit Card?

Axis Magnus now competes favorably with ultra-premium credit cards like HDFC Diners Club Black and HDFC Infinia as a result of recent modifications to its features. The following standout qualities of this card make it worthwhile to apply:

- 25,000 bonus points after spending Rs. 1 lakh each month.

- 12 eDGE Points are generously awarded for every Rs. 200 spent.

- 8 additional guest visits are free, and the primary cardholder has unrestricted access to overseas lounges.

- Transfer at an appealing ratio of 5:4 to numerous airline and hotel reward programmes.

- Luxury Airport Concierge and Medical Concierge service.

For individuals who spend significantly, the Axis Magnus Credit Card is an ideal choice, as it provides generous rewards to its users and includes a monthly milestone benefit of 25,000 points. The value of these 25,000 points becomes substantial when transferred to a flight or hotel loyalty program. At a ratio of 5:4, 25,000 points would convert to 20,000 points. With the option to get travel benefits to this extent along with complimentary lounge access, the card holds excellent value for frequent travelers.

How To Apply For The Axis Bank Magnus Credit Card?

The actions you must follow in order to apply for this Credit Card are listed below:

- Visit Axis Bank’s official website.

- Scroll down and select “Credit Card.”

- You must choose the desired card on the subsequent page after being transferred there.

- You must click “Apply Now” on the new page that will open.

- Decide if you are currently a customer of Axis Bank. If you are a customer, select ‘yes,’; otherwise, select ‘no.’

- Your full name, nation, city of residence, cellphone number, contact information, occupation, and monthly income should be entered in the fields.

- Enter the code and select the checkbox to authorize the lender to contact you regarding your credit card application to continue. Select “Call Me.”

- You will be contacted by a bank representative who will help you with the application.

- You can also bring the essential documents to the nearest Axis Bank branch. You will receive help from a bank employee during the application process.

How To Apply In Offline Mode –

You can come into any Axis bank branch with all the necessary documentation to apply offline, and they will help you complete the application.

Axis Bank Magnus Credit Card Payment Options

You have online payment and as well as offline payment options for making the credit cards payment. Also, the following options exist for paying off Axis Bank Credit Card balances:

- Clear the credit card dues through cash.

- Use the cheque for credit card payments.

- Pay the bills through bill desk.

- Apply the Auto-Debit facility for convenient payment.

- Pay the bills using a debit card from a different bank.

- Payments made with a credit card can also be made via the Axis Net banking service.

Axis Bank Magnus Credit Card Limit

Depending on the applicant’s credit history (CIBIL score), income, and other circumstances, the Axis Magnus credit card limit might range from Rs. 25,000 to Rs. 5 lakhs. You can request to increase your credit card limit after one year of diligent usage.

Similar Credit Cards

| Credit Card Name | Feature |

| HDFC Diners Club Black Credit Card | Free annual memberships are given to Club Marriott, Forbes, Amazon Prime, Swiggy One, MMT BLACK, and Times Prime. |

| SBI Aurum Credit Card | Unlimited use of the international lounge; 1.99% currency markup. |

| ICICI Emerald Credit Card | The use of domestic and foreign lounges is free and unrestricted. |

| HDFC Infinia Credit Card | The first year of Club Marriott membership is free, and primary and add-on members have unrestricted access to the lounge. |

| IndusInd Bank Legend Credit Card | For primary and add-on cardholders, Priority Pass membership is free, giving them access to 700+ lounges globally. |

How To Reach The Customer Care Of Axis Bank Magnus Credit Card?

If you have any questions regarding the Axis Magnus Credit Card, you can always contact the Axis Bank customer care at 1800 419 0065. Alternatively, if you prefer to put your concerns in writing, you can do it at the Axis Bank official website.

Axis Bank Magnus Credit Card vs HDFC Infinia Credit Card vs HDFC Diners Club Black Credit Card

The HDFC Infinia and Diners Club Black credit cards compete with the Axis Bank Magnus card when it comes to super-premium credit cards. Similar joining fees apply to all three cards, which also provide a range of introductory perks, milestone, film and dining benefits, trip advantages, and much more.

The variances among the three cards, however, are numerous, and we have highlighted those differences in the chart below.

| Categories | Axis Bank Magnus Credit Card | HDFC Infinia Credit Card | HDFC Diners Club Black Credit Card |

| Rewards Rate | Spend Rs. 200 and get 5x EDGE Reward Points on the TravelEdge platform to receive 12 EDGE Reward Points. | For every Rs. 150 spent on bus, aeroplane, hotel, and train tickets as well as Flipkart purchases made through SmartBuy, customers get 5 Reward Points. | For every Rs. 150 spent, you earn 5 reward points. SmartBuy offers 10X Reward Points, and weekend eating offers about 2X. |

| Rewards Redemption | You may use EDGE Reward points to buy goods and shopping coupons. Edge Reward Points equal Rs 0.20. To partner with airlines and hotels like Etihad, ITC, Marriott, Turkish Airlines, and more, EDGE Reward Points can be transferred at a 5:4 ratio. | To use towards hotel or travel reservations through SmartBuy, 1 reward point is equal to 1 rupee. To be redeemed with Tanishq or Apple through SmartBuy, 1 reward point is equal to 1 rupee. To use towards buying something from the HDFC catalogue, 1 reward point is equal to Rs. 0.5. 1 reward point is equal to Rs. 0.3 in cashback. Reward Points equal one AirMile. | Reward Points can be redeemed for one rupee when booking hotels or flights. To use towards product purchases from the HDFC catalogue, 1 reward point is equal to Rs. 0.5. 1 reward point is equal to Rs. 0.3 in cashback. Reward Points equal one AirMile. |

| Welcome and Renewal Benefits | After completing your membership or renewal fee, you’ll receive a free national flight ticket worth Rs. 10,000 or a free Rs. 10,000 Tata Cliq gift card. | Upon completion of the membership or subscription price, 12,500 reward points are awarded. | Amazon Prime, MMT Black, Swiggy One, Forbes, Club Marriott, and Times Prime annual memberships are all free. |

| Milestone Benefits | If you spend Rs. 1 lakh or more in a month, you’ll receive an additional reward of 25000 EDGE Reward Points. | _ | If you spend at least Rs. 80,000 per month, you can get a free month of Cult.fit Live or Rs. 500 in Tata Cliq, BookMyShow, or Ola Cabs gift cards. You can also get free annual memberships if you spent at least Rs. 8 Lakhs the year before. |

| Additional Benefits | Free admission to eight international and domestic lounges. 8 VIP assistants provide airport concierge services such as check-in, immigrants, porter services, etc. BOGO discount on movie tickets purchased from BookMyShow services for travel and concierge medicine Insurance protection, includes a credit shield policy and a 500 USD luggage delay or loss policy2% markup on international transactions 1% of gasoline surcharges on transactions between 400 and 4000 rupees are waived. | For primary cardholders and add-on cardholders, unlimited access to local and foreign lounges Free Club Marriott membership 1+1 with buffet at affiliated ITC hotels Unlimited rounds of golf at some international and Indian courses 24×7 international personal shopper Good Food Trail programme offers fantastic dining perks with 1+1 at certain restaurants and flat rate 25% discount at 2,000 or more restaurants Unexpected air death insurance up to 3 crore rupees, emergency hospitalization abroad up to 50 lakh rupees, and credit shield up to 9 lakh rupees Foreign markup fee of 2% 1% of gasoline surcharges are waived for transactions between 400 and 1,000,000 rupees. | Unlimited access to airport lounges both at home and abroad Purchase hotel and/or flight tickets from more than 150 domestic and international airlines. offers at prestigious beauty salons, fitness centres, spas, etc. twice for weekend meals 6 free rounds of golf each quarter 1% off the gasoline surcharge with a minimum purchase of Rs. 400 2 crore rupees in coverage for air accidents, 50 lakhs in coverage for abroad emergency hospitalization, and 55,000 rupees in coverage for lost or delayed baggage. 2% markup on foreign exchange |

| Joining Fee | 10000 rupees annually plus taxes Paying a minimum of Rs. 15 Lakhs in the prior year is required to be exempt from the renewal charge. | 12500 rupees plus taxes Paying a minimum of Rs. 10 Lakh in the preceding year is required to be exempt from the renewal charge. | 10,000 rupees plus taxesIf you spent a minimum of Rs. 5 Lakhs in the previous year, the renewal cost will be waived. |

| Eligibility | A minimum yearly income of Rs. 18 lakhs | Only if invited | Minimum monthly salary of Rs. 1.25 lakhs and minimum annual salary of Rs. 21 lakhs for self-employed individuals |

Axis Bank Reserve Credit Card Vs. Axis Bank Magnus Credit Card

| Features/Charges | Axis Bank Reserve credit card | Axis Bank Magnus credit card |

|---|---|---|

| Joining Fees | Rs. 50,000 + taxes | Rs. 10,000 + taxes |

| Annual Fees | Rs. 50,000 + taxes | Rs. 10,000 + taxes |

| Welcome Benefits | After paying the application cost and renewing your card membership each year, you will receive 50,000 reward points. | Following the initial setup of your Axis Bank Magnus card, you are eligible to receive a Tata Cliq Voucher valued Rs. 10,000 or a free domestic flight as part of the welcome benefit. |

| Cashback / Rewards point | Get 15 Edge Reward Points for every Rs. 200 you spend using this card, plus get 2X Edge Reward Points for all your foreign purchases. | With this card, you can earn 12 Axis EDGE REWARDS Points for every Rs. 200 you spend on retail transactions. |

| Dining benefits | Get a free Eazy Diner Prime membership, which offers 25% off at a variety of restaurants, a maximum discount of Rs. 500 off on the second ticket when you use the Buy One Get One offer on BookMyShow, and 20% off at participating restaurants when you use the Dining Delights programme (five times per month). | Use this card to receive a 20% discount at participating restaurants under the ‘Dining Delights’ programme of Axis Bank. |

| Travel benefits | Use this card to receive free, unlimited entry to domestic airport lounges every three months. | Get 5X Edge Rewards on Travel Edge purchases, enjoy unlimited domestic airport lounge access each year, and Priority Pass* offers unlimited free foreign lounge visits each year. |

| Annual fees waiver | On annual expenditures of more than Rs. 25,00,000, the annual fee is waived. | On annual expenditures of more than Rs. 15,00,000, the annual fee is waived. |

| Fuel surcharge waiver | At all fuel pumps in India, use this card to receive a 1% fuel surcharge waiver. | At all fuel pumps in India, use this card to receive a 1% fuel surcharge waiver. |

Conclusion

The Axis Bank Magnus credit card is a wonderful choice for high net worth people who favour an upscale lifestyle, despite the hefty annual joining fee. It provides excellent advantages for domestic and international travel, upscale eating, a low interest rate, and a moderate foreign exchange markup cost.

The card is very similar to HDFC’s Infinia and ICICI’s Emerald credit cards. The additional medical benefits that this card provides set it apart from the other two. Before making a choice, it is best to learn about the benefits that its competitors HDFC Infinia and ICICI Emeralde provide.

FAQs

What is the maximum usage limit of the Axis Bank Magnus Credit Card?

The usage limit of the Axis Bank Magnus card tends to vary from one individual to another. To know what your limits are, all that you have to do is log into your credit card account or take a look at your credit card statement.

How do I activate my Axis Bank Magnus card?

You can activate your Axis Bank Magnus Credit Card using netbanking services, the Axis mobile app, or through an ATM.

What is the minimum salary required for an Axis Bank Magnus Credit Card?

You must be earning a salary of Rs. 18 Lakhs per annum or have filed an Annual Income Tax Return for Rs. 18 Lakhs to be eligible for the Axis Bank Magnus Credit Card.

What are the special features of Axis Bank Magnus Credit Card?

Following are the special features of the Axis Bank Magnus card:

- Choose 1 complimentary economy class flight ticket across any domestic location or a Tata CLiQ voucher worth Rs. 10,000 as an annual benefit.

- Get 8 complimentary VIP Assistance Services for a hassle-free airport transfer.

- Enjoy unlimited complimentary visits to international and domestic airport lounges with the Priority Pass Card.

- Get flat 15% off on your luxurious stays at Oberoi properties across India and also avail of the benefit of a complimentary room upgrade.

- Buy 1 movie or non-movie ticket and get up to Rs. 500 off on the second ticket.

- Get up to 20% discount at 4000+ partner restaurants across India.

- Stay protected with air accident cover worth Rs. 450 Lakhs, purchase protection of Rs. 2 Lakhs, lost card liability up to your card credit limit, credit shield of Rs. 5 Lakhs and more.

- Get your annual fee of Rs 10,000 + Taxes waived off on spending Rs. 15 Lakhs in the preceding year.

- Get attractive Axis Edge Reward Points on spending with the card.

What are the Axis Bank Magnus Card membership fees?

The Credit Card has a membership fee of 10,000.

Can I pay my bills with the Axis Magnus Credit Card?

Yes. The Magnus Credit Card can be used to pay bills. That isn’t everything. You will also receive 12 EDGE Rewards Points for every Rs. 200 spent.

Can the priority pass be used for domestic airport lounges as well?

The priority pass is complimentary for international airports outside India. Within India, you might have to pay a charge to use it.

What offers does the card have?

The card has a lot of offers on movies, dining, travel, Insurance, Health and Wellness, lifestyle, and entertainment.

What is the customer care number for Axis Bank Magnus Credit Card?

The customer care number is 1800 419 0065

What should be my income to be eligible to apply for the card?

The minimum salary needed to apply for the card is Rs. 18 lakhs per annum.

Read More

I am an Undergraduate Student pursuing BA English Hons in KIIT University. My hometown is in Cuttack, Odisha. My hobbies include dancing and singing.