- Fees And Charges Of OneCard Credit Card

- Features And Benefits Of OneCard Credit Card

- Eligibility Of OneCard Credit Card

- Documents Required For OneCard Credit Card

- Steps For Applying Online FOR OneCard Credit Card

- OneCard Credit Card Rewards

- Reward Redemption

- Cards Similar To OneCard Credit Card

- Credit Limit Of OneCard Credit Card

- OneCard Vs. Pay Later Cards

- OneCard Vs. Slice Card

- OneCard Vs. UniCard

- Best OneCard Credit Cards List

- IDFC Bank OneCard Credit Card

- Federal Bank OneCard Credit Card

- OneCard Customer Care Number

- Conclusion

- FAQs

- Read More

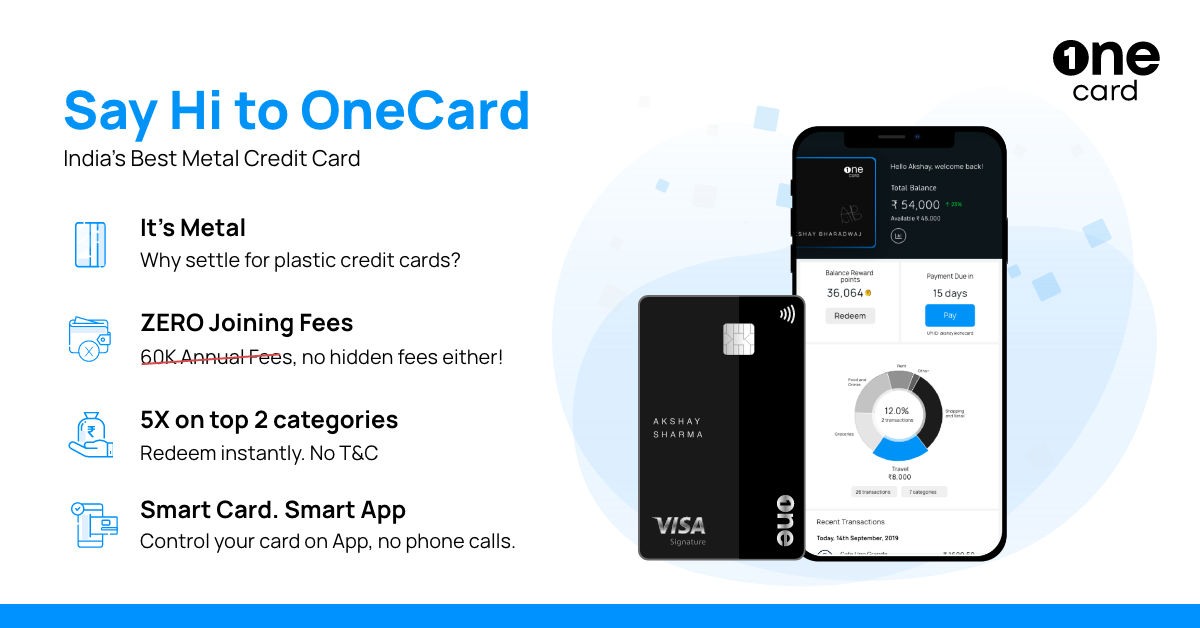

Several service providers, notably SBM Bank, South Indian Bank, Federal Bank, BOB Financial, and CSB Bank collaborate to offer OneCard, a metal credit card. This lifetime-free credit card is ideal for first-time credit card users who want to accumulate reward points from their transactions. One of the best aspects of this credit card is the fact that it offers 5X rewards on the top 2 expenditure categories rather than restricting bonus earnings to certain categories. Continue reading to learn about the details of this credit card & see if it’s a good fit for you.

You’ve probably heard that bank cards are made of plastic. They are plastic objects with a chip within them. However, the OneCard Credit Card, a brand-new metallic credit card, has just been introduced. Although this card shares many characteristics with other cards, its construction material gives it a distinctive quality. The card’s lack of a joining or renewal charge is its strongest feature. As a result, you can use this card for many benefits without having to pay any fees. The sleek face of the metal credit card, which simply has the cardholder’s name on it, looks modern. On the reverse of the card, the Card number, Expiration date, and CVV are printed.

Fees And Charges Of OneCard Credit Card

The OneCard Credit Card has minimal fees. The following is an inventory of OneCard Credit Card fees:

| Charges | Details | Amount |

| Joining Fee | Primary card Add- on card | Nil Nil |

| Annual Fee | Primary card Add-on card | Nil Nil |

| Replacement Card | Plastic Card (first time) Second time onwards Metal Card | Nil Rs. 145 Rs. 3000 |

| Card Cancellation | For cards cancelled within 6 months of virtual card activation | Rs. 3000 |

| Cash Advance Fee | ATM cash withdrawal | 2.5% of the transaction with a minimum of Rs. 300/- |

| Service | Rewards redemption fee Forex Markup Fee Overlimit fee | Nil 1% 2.5% of the overdrawn amount |

| Finance Charges | For liability beyond the interest- free period i.e., 48 days | 2.5% to 3.5% per month |

| Default Charges | Delayed penalty | 2% of the transaction amount for repayment via select card BINs (Bank Identification Number) |

Features And Benefits Of OneCard Credit Card

You must be thrilled to find out what this complimentary credit card can do for you. Here are a few unique advantages that may surprise you.

No Additional Fees

- There is no cost associated with this credit card, and there is also no application charge.

- The use of this credit card is not subject to a renewal fee.

- When redeeming points for different brands, there are no fees.

Card Management Through A Mobile App

- To manage the card, install the OneCard mobile app from the App Store or Play Store.

- From the OneCard App, choose the transaction cap.

- Manage a variety of activities from the app, including local transactions, foreign transactions, internet actions, payments via contactless technology, and others.

Metal Card

- Metal has been employed to create the OneCard Credit Card.

- Use a distinctive metal credit card rather than a plastic one.

- With this credit card, live the good life.

Simple And Straightforward Activation

- Digitally activate the card without being present at the bank.

- Within five minutes, this credit card is activated.

Rewards From Reward Points

- Earn 5X more reward points for your first two purchase categories.

- Your account will be instantly updated with the reward points.

- The reward points have no time limit on them.

- To claim the reward points, simply swipe your One Card credit card.

- There won’t be any rounding and your account will be rewarded with even fraction reward points.

EMI Dealings

- Contribute a portion of your transactions to EMIs.

- To benefit from EMI transactions, no documentation is required.

- EMI transactions allow you to earn reward points.

- From the EMI dashboard, manage your EMIs.

Eligibility Of OneCard Credit Card

OneCard Credit Card qualifying standards are very straightforward.

- When applying for a credit card, the applicant must be at least 18 years old.

- The credit card will be available to both salaried and independent workers.

- The candidate must be an Indian resident.

- OneCard is currently available by invitation only.

Documents Required For OneCard Credit Card

The basic documents required to avail of OneCard Credit Card are:

Address Proof:

- Aadhar Card

- Voter’s ID Card

- Passport

- Driving Licence

Photo ID Proof:

- PAN

- Address Proof

- Voter’s ID Proof

- Passport

- Driving Licence

Income Proof For Salaried Individuals:

- Salary slips for the last three months

- Latest ITR

- Latest Form 16

- Bank account statement for the last three months

Income Proof For The Self- Employed

- Audited Financials like Balance Sheet and Profit and Loss Account for the last two years

- ITR for the last two years

- Bank Account statement for the last 12 months.

Any other documents as required by the collaborating bank

Steps For Applying Online FOR OneCard Credit Card

Five collaborating banks offer the OneCard Credit Card:

- South Indian Bank

- Federal Bank

- Bank of Baroda Financial

- IDFC First Bank

- SBM Bank

To submit an application for the OneCard Credit Card, simply stop by the store of one of these banks that is the closest to you. However, you must take the following actions if you intend to submit an online application for it:

Step 1: Visit the official website of OneCard.

Step 2: Click the “Apply Now” button on the top of the screen to start the application process.

Step 3: Enter your phone number and other necessary details to apply for the One Card Credit Card.

Step 4: You can also select the WhatsApp application status update to track the status of your OneCard application.

As an alternative, you can use the OneCard mobile app to apply for a credit card. Just install the application for your smartphone from the Google Play Store or App Store, register, and submit an application for a credit card. It is quite rapid and hassle-free.

You must go through the onboarding procedure after being chosen for the OneCard and having a successful application process. You can immediately use the virtual form of your card after registering for one via the process.

OneCard Credit Card Rewards

- You earn 1 Reward Point per Rs. 50 spent with your One Card Credit Card.

- You can also earn fractional Reward Points on One Card. For example, if you spend Rs. 175, you will earn 3 Reward Points against Rs. 150 and 0.5 Reward Points for the remaining Rs. 25. Therefore, in total, you actually earn 3.5 Reward Points on the expenditure of Rs. 175 with your One Card Credit Card.

- You earn 5x Reward Points on the top two spend categories of the month. For example, if the top two spend categories for a given month are travel and grocery, you earn 5x Reward Points on travel and grocery spends in that month. The top two spend categories are calculated for every month separately- that is, your top two spend categories for the month of February may be grocery and travel and for the month of March may be bill payments and online shopping. This 5x Reward Points benefit on the top spend categories is applicable only if you use your One Card for purchases in at least three different spend categories.

Reward Redemption

he Reward Points earned on One Card Credit Card can be redeemed against cashback at a value of 1 Reward Point = Rs. 0.10.

Cards Similar To OneCard Credit Card

The OneCard Credit Card is ideal for people who wish to use the Card as much as possible to earn the most benefits. Other cards offered by different institutions are more suited for rewards. Below are a few credit cards that relate to the OneCard Credit Card.

| Credit Card | Rewards |

| OneCard Credit Card | One reward point for every Rs. 50/- spent on the credit card 5x reward points for the top 2 spends in a month. |

| Federal Bank SBI Credit Card | 10x reward points for all spends at Grocery Stores and Departmental Stores Spend Rs. 2000 or more within 60 days of the activation of the Card and earn 2000 bonus reward points |

| SBI Simply Click Credit Card | 10x reward points for online transactions with Amazon, Netmeds, Apollo 24×7, BookMyShow, ClearTrip, EazyDiner and Lenskart. 5x reward points for all other spends. |

| American Express Membership Rewards Credit Card | One reward point for every Rs. 50/- spent except on fuel, insurance and utilities. Use the credit card 4 times for Rs. 1000/- or more in a month and earn 1000 bonus membership reward points Spend Rs. 20000/- or more in a month and earn 1000 bonus membership rewards. Earn 5000 bonus membership reward points on renewal of the Card in the first year. |

| Standard Chartered Manhattan Platinum Credit Card | 5% cashback for transactions at supermarkets 3 x reward points for all other spends |

| Standard Chartered Emirates World Credit Card | Earn six skyward miles for every Rs. 150 on Emirates transaction. Earn three skyward miles for every Rs. 150 on other transactions Get 5% cash back at participating duty-free stores worldwide |

| Yes Prosperity Rewards Plus Credit card | Four reward points for every Rs. 200/- spent on all categories other than select categories. Two reward points for every Rs. 200/- spent on select categories. Accelerated reward points for select transactions on YESCART |

| HDFC Bank Diners Club Black Credit Card | Five reward points for every Rs. 150 spent. 10x reward points for transactions via SmartBuy 2x reward points for weekend transactions. |

| SBI Card Prime Advantage | 10 reward points for every Rs. 100 spent on Dining, Groceries, Departmental Stores and movie. |

Credit Limit Of OneCard Credit Card

The One Card’s credit limit is variable and is based on your Cibil Score and salary. You will receive a high credit limit on OneCard if you have a Cibil Score of 750 or higher and a high salary. A rapid acceptance for the credit card is also facilitated by a high Cibil Score.

OneCard Vs. Pay Later Cards

Like other pay-later cards like Slice Super Card and UNI Card, One Card is issued by the fintech company FPL Technologies Pvt. Ltd. in partnership with its financial partners. One Card is a true credit card, whereas Slice Card & UNI Card are pay-later cards that effectively provide you a personal loan against a revolving line of credit. This makes One Card fundamentally distinct from these pay-later cards.

OneCard Vs. Slice Card

To understand the key difference between OneCard and Slice Super Card, refer to the following table:

| OneCard | Slice Card |

| It is a real credit card. Cardholders need to pay their bills every month and if they don’t pay the full bill, they need to pay interest charges as well. Rewards the cardholders in the form of Reward Points. To get an unsecured OneCard credit card, you might need a credit score. | It is a buy now pay later card that functions very similar to credit cards. Cardholders can split their monthly spends into three parts and pay it in three months with no extra charges. Rewards you in the form of cashback. You don’t need to have a credit score. |

OneCard Vs. UniCard

| OneCard | UniCard |

| A credit card offered by OneCard in partnership with banks. It earns you reward points on regular spends. Charges an interest on missed or delayed payments. International transactions are allowed with a forex markup fee of 1%. | A buy now pay later credit card. No rewards are earned on regular spends. But, the cardholders only earn a 1% cashback on paying the full bill. Cardholders can split their bills into three equal monthly installments without any extra fees. No interest charges are there but a late fee is charged for delaying the payments. No international transactions are allowed. |

Best OneCard Credit Cards List

As mentioned earlier, OneCard offers credit cards in partnership with some of the popular banks/credit card issuers in India. Following is the list of best OneCard Credit Cards:

IDFC Bank OneCard Credit Card

The IDFC OneCard is a co-branded fintech card that is offered by OneCard in partnership with IDFC First Bank. It is a lifetime fee credit card that can be used for online as well as offline transactions. With this card, the customers can earn 5x Reward Points on any two categories where they spend the most and this is what makes it a great choice for everyone.

Federal Bank OneCard Credit Card

It is another great card offered by OneCard in collaboration with the Federal bank. It is a metal card that you can activate in seconds in the OneCard app and get the physical card delivered within 3-5 business days. It is a lifetime free credit card with all the features very similar to that of the above-mentioned IDFC First Bank OneCard.

OneCard Customer Care Number

The OneCard Credit Card customer care number is 1860-266-1111 and you can call on this number anytime. This is a toll-free number and you can raise any type of query you are having on this credit card.

You can call the customer care via phone on 1800-210-9111 or raise a ticket in the OneCard App for initiating closure of card subject to the outstanding dues being cleared.

Conclusion

The procedure of applying for a OneCard Credit Card is simple and quick. Simply follow the above instructions when applying for the card online if you don’t want to physically fill out the application at the bank location. In contrast, if you’re searching for another great credit card with straightforward features and outstanding rewards, Fi has exactly what you need. We launched a credit card with our co-brand after collaborating with Federal Bank, an authorised credit card issuer. Every time you make a purchase from one of India’s leading brands, you receive a 5% valueback and benefits. Additionally, you have access to unique benefits like no foreign exchange fees, access to lounges, personalized notifications, expenditure insights, and more.

FAQs

What is the maximum credit limit offered on OneCard Credit Card?

The maximum credit limit offered by the bank differs from applicant to applicant. The bank decides the maximum credit limit based on your income, eligibility and other factors. So, the applicant will get to know about the credit limit only after getting approved for the credit card.

I don’t have a job. Can I apply for OneCard Credit Card?

Yes, people with no job can also apply for the OneCard. In such a case, you can apply for a secured OneCard that is offered in collaboration with SBM Bank. A secured credit card is offered against a fixed deposit, and its credit limit is a little bit lesser than the fixed deposit amount. The good thing is that along with your credit card, you can earn interest on your fixed deposit.

What is the forex markup fee for OneCard Credit Card?

OneCard comes with a lower forex markup fee as compared to the other credit cards available in the market. The forex markup fee charged by OneCard is 1%, which makes it easier for you to make transactions in foreign currency.

Can I build my credit score using OneCard Credit Card?

Yes, OneCard Credit Card is suitable for people who are new to credit. You can apply for this credit card and start building your credit score by using it efficiently. In order to build your credit score, make sure you make your payments timely and maintain your credit utilization ratio (preferably below 30%).

Is OneCard Credit Card a Virtual Card?

OneCard Credit Card is a metal card, and there is also a virtual version of the Card as well on the OneCard app. You can use the Virtual Card for any online or app-based purchases or transactions.

What to do if I have misplaced my Onecard Credit Card?

If you have misplaced your OneCard Credit Card, you can get it blocked temporarily. If you find the Card, you can request a reactivation of the Card. If you are convinced that the Card is lost, you can apply for a replacement card.

What is the OneCard App?

OneCard app is a powerful app that helps the cardholder manage various aspects of the credit card. It helps to manage your credit limit

- Track your available balance

- Analyse the transactions and spends

- Keep track of supplementary credit card transactions

- Redeem reward points instantly

- Download and view statements

- Pay utility bills

- Use Virtual OneCard for online transactions

Is OneCard good or bad?

OneCard is an excellent credit card, especially if you want an entry-level one card. While it can’t compete with other premium cards, it has its set of benefits and rewards. For example, it offers free lifetime access and no joining or annual renewal fee.

So, if you are new to credit cards, opting for a OneCard can be a solid choice.

OneCard customer care number?

The OneCard Credit Card customer care number is 1860-266-1111 and you can call on this number anytime. This is a toll-free number and you can raise any type of query you are having on this credit card.

You can call the customer care via phone on 1800-210-9111 or raise a ticket in the OneCard App for initiating closure of card subject to the outstanding dues being cleared.

Read More

I am an Undergraduate Student pursuing BA English Hons in KIIT University. My hometown is in Cuttack, Odisha. My hobbies include dancing and singing.