- Features And Benefits Of Flipkart Axis Bank Credit Card

- Cashback Advantages

- Travel Advantages

- Fuel Advantages

- Dining Advantages

- EMI Advantages

- Limit For Axis Bank Credit Cards On Flipkart

- Documents Needed To Obtain The Axis Credit Card From Flipkart

- Evidence Of Residency

- Qualifications For The Axis Bank Credit Card From Flipkart

- How To Submit An Application For An Axis Bank Credit Card Via Flipkart

- Advantages Of Utilizing Axis Flipkart Credit Card

- Customer Service For Flipkart Axis Bank Credit Cards

- Fees And Charges Of Flipkart Axis Bank Credit Card

- Comparison: Flipkart Axis Card Vs. Amazon Pay ICICI Card Vs. Paytm SBI Card

- Cards Similar To Flipkart Axis Bank Credit Card

- FAQs

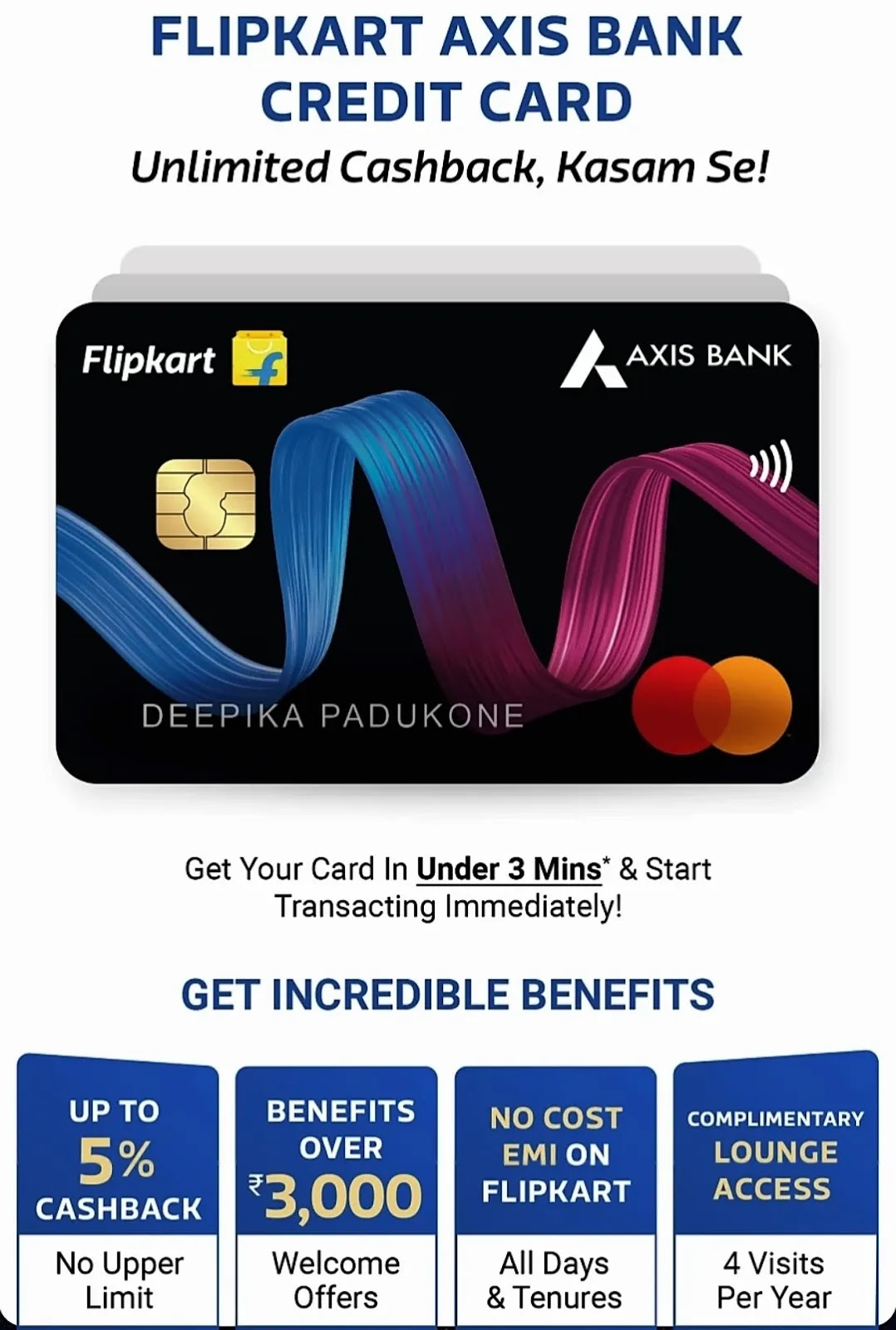

One of the top payback credit cards in India is the Flipkart Axis Bank Credit Card. On Flipkart, Myntra, and other partner websites, users will receive up to 5% cashback, and all other purchases will receive a flat 1.5% cashback. Following the 2% cashback offered by the Axis Bank Ace Card, this is the market’s second-highest flat reward rate. The Flipkart credit card’s best features are geared towards Flipkart & its affiliate retailers because it is a co-branded card. Find out if this card is the right choice for you by reading on.

One of the largest banks in the nation, Axis Bank, offers a variety of credit cards that satisfy the demands of its customers in a number of areas, including travel, lifestyle, and retail. This Axis Bank Flipkart credit card represents a jointly issued shopping credit card between Axis Bank and Flipkart that comes with an extensive list of features and benefits, including rewards on purchases, access to airport lounges, and fuel advantages.

Because it is simple and there are several deals floating around, online shopping is booming right now. Similar to Amazon, Flipkart offers numerous discounts, and if you want even more, you can utilize a Flipkart Axis Bank Credit Card. There are discounts available on Myntra, PVR, Uber, as well as Flipkart. You can use this credit card to take advantage of them all. Let’s examine each of the credit card’s features and offers.

Features And Benefits Of Flipkart Axis Bank Credit Card

- The Axis Bank Flipkart credit card comes with joining and activation incentives of Rs. 3,300.

- Get a Rs. 500 Flipkart voucher when you make your first purchase.

- Free 6-month subscription to Gaana.com using your credit card.

- Get a price reduction of Rs. 500 on Goibibo when using your credit card to make domestic hotel reservations with a minimum purchase of Rs. 2,000.

- Get a reduction of Rs. 500 on your MakeMyTrip domestic hotel reservation of Rs. 2,000.

- With this credit card, you can receive 15% reward up to Rs. 500 on your initial Myntra purchase.

- New users of Urban Clap receive a 20% discount, good for up to Rs. 400 on credit card purchases.

Cashback Advantages

- 5% off of purchases from Flipkart, Myntra, and 2GUD.

- Get 4% cashback at all your favourite retailers.

- On all other categories, there is a 1.5% cashback.

Travel Advantages

Receive 4 complimentary trips to domestic airports each year when you use with Axis Bank Flipkart credit card.

Fuel Advantages

- At all petrol stations in India, use your credit card to get a 1% fuel surcharge waiver.

- Only transactions totaling between Rs. 400 and Rs. 4,000 are eligible for the promotion.

- The gasoline surcharge’s GST will not be refunded.

Dining Advantages

- Get a 20% discount at participating restaurants when you use an Axis Bank Flipkart credit card as part of the Axis Bank “Dining Delights” programme.

- It is suggested that you go to the Axis Bank website to view the list of restaurants.

EMI Advantages

- You can use the credit card to turn your purchases into low-interest EMIs with a variety of tenure options.

- With your credit card, only purchases totaling a minimum of Rs. 2,500 can be changed to EMIs.

Click Here: https://www.bankbazaar.com/credit-card/axis-bank-flipkart-credit-card.html

Limit For Axis Bank Credit Cards On Flipkart

The Axis Bank Flipkart card’s credit limit is entirely at Axis Bank’s discretion. Before deciding on a credit limit for your card, the bank will take into account a number of variables, including your annual income, credit score, credit report, and payback history for previous and current debts.

Click Here: https://www.bajajfinservmarkets.in/credit-card/flipkart-axis-bank-credit-card.html

Documents Needed To Obtain The Axis Credit Card From Flipkart

Identity verification, Form 60,income verification, color pictures, PAN cards, and residential verification of the principal applicant are the documents needed when applying for the card.

The full list of required documents is provided below:

As proof of income, a color photograph, the most recent pay slip, Form 16, or IT return copy, PAN card photocopy, or Form 60.

Evidence Of Residency

- Telephone bill, a passport, a ration card, and an electricity bill serve as identity proof.

- ID card, Aadhaar.

- PAN card, driving license and passport.

Qualifications For The Axis Bank Credit Card From Flipkart

- The extra credit user must be at least 15 years old.

- The person who holds the card must be an Indian citizen, either permanently or temporarily.

- The main credit cardholder is required to be between the ages of 18 and 70.

How To Submit An Application For An Axis Bank Credit Card Via Flipkart

You have the option of applying for an Axis Bank Flipkart credit card offline or online. You have three options for applying for the card: online, in person at an Axis Bank branch, or by calling customer service.

One may register for the card online either the BankBazaar website or the Axis Bank website. On the Axis Bank website, go to https://www.axisbank.com/retail/cards/credit-card/flipkart-axisbank-credit-card/features-benefits to apply for the card.

The form that appears after clicking the link must be filled out with your basic information, including your name, cellphone number, type of employment, monthly income, and PIN code.

Advantages Of Utilizing Axis Flipkart Credit Card

- 20% off Urban Clap is offered to new users with credit cards, up to Rs. 400.

- 5% off of purchases from Flipkart, Myntra, and 2GUD.

- Get 4% cashback at all your favourite retailers.

- On all other categories, there is a 1.5% cashback.

Customer Service For Flipkart Axis Bank Credit Cards

There are several ways to get in touch with the Flipkart Axis Bank credit card support team.

- Contact Axis Bank at 1860-419-5555 or 1860-500-5555 for credit card assistance.

- Support services are available on both the Axis Bank mobile app and official website. One can choose between email, SMS, and personal support executives as their method of contact.

Fees And Charges Of Flipkart Axis Bank Credit Card

Following are the Flipkart Axis Bank credit card charges:

- Joining fee: Rs. 500

- Annual fee: Rs. 500

- Card replacement fee: Rs. 100.

- Cash payment fee: Rs. 100.

- Finance charges for retail purchases and cash: 3.6% per month.

- Cash withdrawal fee: 2.5% of the cash amount (minimum Rs. 500).

- Overdue penalty/ late payment fee: Up to Rs. 500, depending on the total payment due.

- Over limit penalty: 2.5% of the over limit amount (minimum Rs. 500).

- Cheque return/ dishonor fee/ auto-debit reversal: 2% of the payment amount (minimum Rs. 450).

- Foreign currency transaction fee: 3.5% of the transaction value.

Comparison: Flipkart Axis Card Vs. Amazon Pay ICICI Card Vs. Paytm SBI Card

One of the many co-branded credit cards introduced with e-commerce platforms over the past two to three years is the Flipkart Axis Bank Credit Card. Let’s compare this card to two other widely used credit cards.

| Parameters | Flipkart Axis Card | Amazon ICICI Card | Paytm SBI Card |

| Maximum Flashback | 5% | 5% | (When using the Paytm SBI Card Select option) 5% |

| Flat Cashback Rate | 1.5% | 1% | 1.5% |

| Welcome Benefit | Benefits of Rs. 1,110 with card | – | Up to Rs. 75,000 in benefits when you sign up for a free Paytm First membership |

| Lounge Access | 4 free trips annually to local airport lounges | No free lounge visit | International: Free Priority Pass worth US $99 Domestic: Free 4 national lounge visits (but only once every three months) |

| Fuel Surcharge Waiver | 1% monthly to a maximum of Rs. 500 | 1% of the gasoline surcharge for each fill-up | Every transaction between Rs. 500 and Rs. 3000 is exempt from the 1% fuel surcharge; the maximum surcharge exemption per statement cycle is Rs. 100 |

Cards Similar To Flipkart Axis Bank Credit Card

| Credit Card | Annual Fee | Comparative Feature |

| Amazon Pay ICICI Bank Credit Card | Nil | Amazon Prime members receive 5% cashback, while non-Prime members receive 3% cashback |

| HSBC Cashback Credit Card | Rs. 750 | 1.5% cashback on purchases made online* and 1% on any additional purchases |

| Cashback SBI Card | Rs. 999 | 5% cashback on all online purchases, irrespective of merchant limits; 1% rebate on all other purchases |

| Standard Chartered Super Value Titanium Credit Card | Rs. 750 | 5% return on payments for fuel, phone, and utility bills |

| HDFC Millennia Credit Card | Rs. 1,000 | 5% cashback on certain purchases, 2.5% cashback on online purchases, 1% cashback on offline purchases, and wallet reloads |

FAQs

Will fuel purchases result in cashback?

- Fuel purchases are not qualified for the cashback, so no. Additional transaction types that are not qualified for the cashback are listed below:

- EMI transactions for buying of vouchers on Myntra and Flipkart

- Post-transactional EMI conversion of purchases

- Transactions filling your wallet

- buying of gold-plated goods

- Money transfers

- Settlement of unpaid balances

- Fees and additional card charges must be paid

Does the Axis Bank Flipkart Credit Card offer rewards?

No, this Axis Bank credit card offers immediate cashback on all purchases in instead of a reward. The statement will immediately reflect the accumulated cashback

What is the markup on foreign exchange?

A markup fee for foreign exchange is applied to each payment you make in a different currency. This rate is 3.50% on Flipkart Axis Bank Credit Cards.

Can I use this credit card to make an ATM cash withdrawal?

Yes. Up to your allotted monetary limit, you may withdraw money. However, the withdrawal fee of 2.5% of the quantity spent or Rs. 500 will be applied, whichever is greater.

What amount of time will it take to process my application?

It may require up to two weeks for the financial institution to issue you a card once you applied for one and filed all the required paperwork.

What are the Flipkart Axis Bank Credit Card customer service numbers?

The following telephone numbers can be used to contact Axis Bank customer service: 1860-419-5555 and 1860-500-5555.

How can I create a PIN on a credit card from Axis Bank?

You may produce a PIN for the Axis Bank credit card promptly by going to any of the bank’s ATMs or by phoning the bank’s customer service line for the credit card. The PIN may be created quickly at the ATM by taking a few simple steps.

Can I obtain my buddy an auxiliary credit card?

No, you may only obtain a credit card as an add-on for your: spouse Son and Daughter (if they are at least 18 years old), parents or Siblings.

What are the annual and introductory fees for the Flipkart Credit Card?

Both the annual fee and the initial enrollment fee for the Flipkart Axis Card are INR 500 + GST. When you apply for the credit card, the amount due must be paid.

How can I have this credit card’s annual fee waived?

There is a yearly charge, but if you spent $25,000 or more the year before, you can avoid paying it. The upcoming year’s annual fee won’t be charged.

What is the interest rate on the Flipkart Axis Credit Card?

The Flipkart Axis Card has an interest rate of 3.4% every month and 49.36% annually. Along with this interest, you must pay the balance due.

Is there a fee for using cash to pay a credit card bill?

Yes, if you pay for the Axis Bank Flipkart card in money to the bank, you will also need to pay INR 100.

Can I use my Axis Flipkart Credit Card to make cash withdrawals from an ATM?

Yes, you are able to withdraw cash from your Axis Flipkart Card, but a fee of 2.5% of the amount removed with a minimum withdrawal amount of INR 500 will be applied.

What is the Axis credit card limit for Flipkart?

The Axis Flipkart card’s credit limit is determined by your income and credit score. Therefore, you will benefit from the substantial credit limit on this credit card if you have a large Cibil Score of 750 or more and a high income.

How long does it take to get a Flipkart Axis Bank credit card approved?

The bank will communicate any decision taken on acceptance or rejection of Flipkart Axis Bank credit card within 21 working days of receiving the application. Cards once approved will be delivered to the registered address within 10 days.

Read more

I am an Undergraduate Student pursuing BA English Hons in KIIT University. My hometown is in Cuttack, Odisha. My hobbies include dancing and singing.